-

View article

#Economy

#EconomyChina: confidence, price war and credibility are the watchwords in this early part of the year

2024/03/26

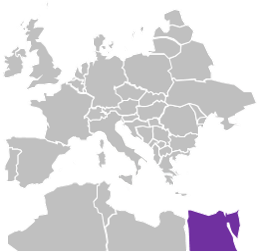

Crédit Agricole in Egypte

Formed in 2006 via successive mergers - Indosuez, CCF, Crédit Lyonnais and Egyptian American Bank – today, Crédit Agricole Egypt is the only French bank operating in Egypt.

-

Credit Agricole Egypt (CAE)

Created in 2006 via successive mergers: Indosuez, CCF, Crédit Lyonnais, and Egyptian American Bank.

In August 2015, CA Egypt joined the EGX 30 – the Cairo Stock Exchange index: the only French bank operating in Egypt, it is also part of the EGX / ESG S&P sustainability index.

Historically dedicated to the Corporate market, CA Egypt became a universal bank, with 50% of its net banking income generated on retail market.

Development of strong synergies to serve Crédit Agricole Group customers, notably with CACIB.

A solid bank with strong financial fundamentals that enabled the bank to face two crises (in 2011 and 2013) and a devaluation of about 50% of the local currency in 2016, maintaining a high level of profitability (RONE > 40%).

-

Key figures

Egypt: 109.3 million inhabitants

416 000 customers

83 branches

2 518 employees

Total assets: 2.3 bn€Highlights - Prizes and Awards

- Acquisition by Crédit Agricole S.A. of a 4.8% stake in Crédit Agricole Egypt, taking the Group’s stake to 65.25%.

- Number 18 in the Forbes Middle East ranking of the “50 most powerful companies in Egypt in 2022”.

- “Best Performing Egyptian Bank 2022” – International Business Magazine and “Most Innovative Retail Banking App Egypt 2022” – Global Banking and Finance Review.

- Egypt’s best banking app – Global Banking and Finance.

- Facial recognition on the Bankimobile app.

- Launch of a personalised bank account for people with disabilities.

- Opening of three new branches based on the Banki Store concept (branches located in the heart of urban areas with innovative services and dedicated solutions).

Ratings

Fitch : BB- stable

(Ratings as of Q1 2021)Source: BPI/FIN - Data at 12/31/2020

-

Strategic approach

MTP 2022 Strategic ambition : be the European bank of reference in Egypt

- Develop business activities through a systematic approach to digitalization and promoting customer-centric innovation;

- Accelerate on customer acquisition;

- Reinforce the bank differentiated positioning on the corporate market and be the leading partner of MNCs and local GEs through the strengthening of expertise and customer satisfaction (e.g. structured finance);

- Develop new activities in synergy with the Group (Leasing - CAL&F, Wealth Management - Indosuez and Insurance - CAA) to take advantage of market growth dynamics.

-

Key economic indicators

France Egype Currency

EUR

EGP

Population (in millions)

67,1

100,9

Population growth rate

0,3

3,1

Nominal GDP (in USD billions)

2 599

362

Real GDP growth, annual

-8,2

3,6

Nominal GDP growth

-6,2

19,7

GDP per inhabitant, current USD

39 907

3 587

Inflation rate

0,5

5,7

Unemployment

8,0

8,3

Household savings rate

21,3

n.d.

Budget deficit/GDP

-9,2

-7,9

source : Insee FMI, ECO (Data at end 2020)