-

View article

#Financial publications

#Financial publicationsPhilippe Brassac discusses the results for the full year and fourth quarter of 2023 as well as the universal banking model

2024/02/08

One century ago: Crédit Agricole came through the Great War

After four years of conflict, the armistice signed on 11 November 1918 marked the end of the Great War. France was among the victors, but this conflict cost her dearly: 1,400,000 French and colonial soldiers lost their lives, many families were decimated, buildings and livelihoods destroyed, and the entire economy was directed towards the war effort and then to rebuilding.

Crédit Agricole was thrown into disarray by the war, and its development put on hold, but afterwards the bank adapted its governance and began to extend its expertise and skills.

Operations disrupted by war

The mobilisation of men of fighting age left only women, elderly men or discharged soldiers to work on the farms, which weighed on demand for loans.

Added to this decline in demand was the fact that many of Crédit Agricole's directors, employees and volunteers were unavailable or scattered. The Reims regional bank had to relocate multiple times as the enemy advanced, the Finistère regional bank could not keep its accounts up to date, and in Côtes-du-Nord, the activities of the regional bank were almost entirely suspended.

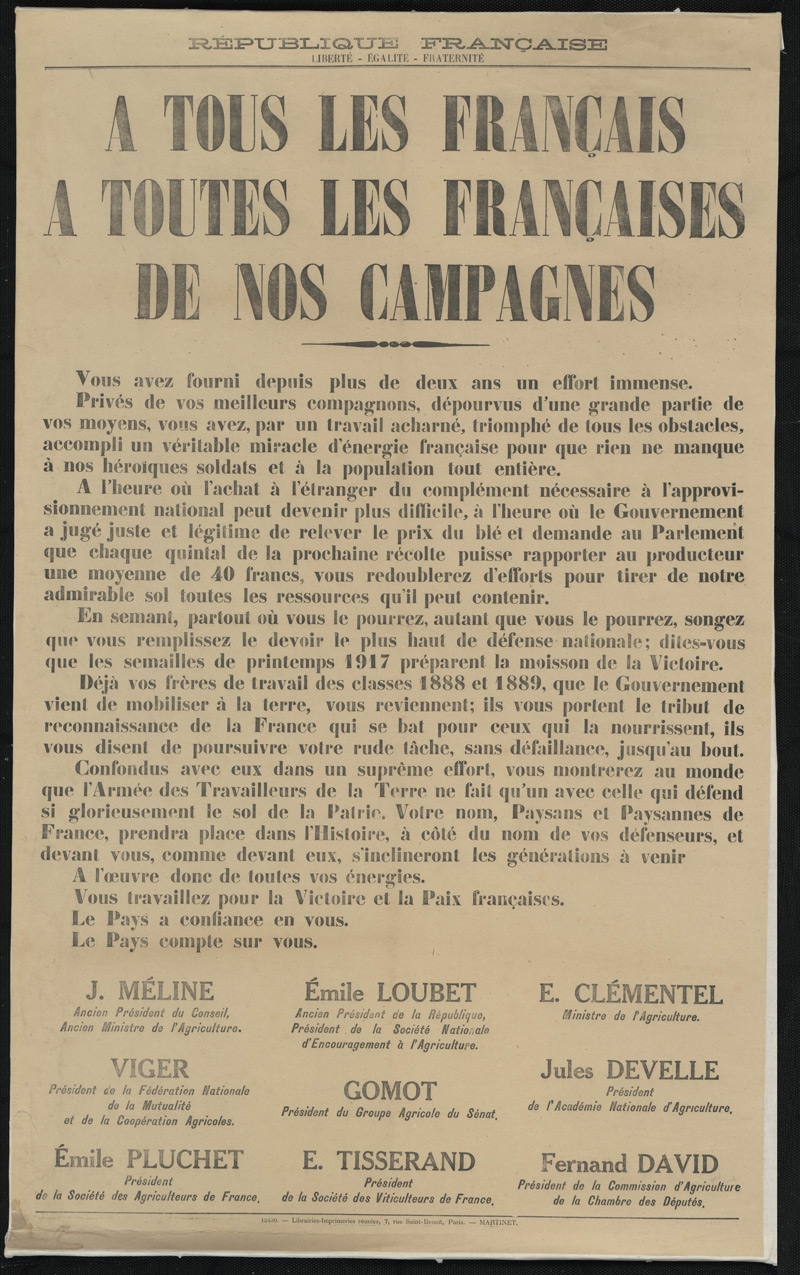

The four ministers for agriculture that were in office during the Great War were, or would become, very closely involved in the operation of Crédit Agricole. In 1917, three of them signed an “appeal to all the French people in our countryside” to produce more in support of the war effort. Crédit Agricole provided the financial backing for this policy of intensive production, particularly by granting advances to communities, departments and cooperatives so that they could cultivate abandoned land. This action would be more effective after the armistice, however, when the labour force returned from the front.

Click on the image to zoom in

Crédit Agricole was also involved in providing aid to wounded men returning to the workforce, and to civilian victims of the war. A law passed in 1918 gave them access to loans of 8,000 francs repayable at a rate of 2% over 15 years, for the acquisition, development or renovation of small, rural properties. An information brochure was published around this time, giving details not only about possible financing opportunities but also about the work that wounded men could do on a farm, depending on their specific handicaps, and using adapted tools.

Post-war restructure at Crédit Agricole

The war highlighted the cumbersome processes at Crédit Agricole, particularly those relating to State grants to the regional banks, for which the quarterly meetings of the Distribution Committee were not adapted to providing a rapid response to applications.

In 1918, Crédit Agricole was still a young institution. The most senior regional banks had barely been in existence for 20 years, and the “institutional pyramid” based on the hierarchy of local banks and regional banks was incomplete, as there was not yet a central institution at the summit.

Since the beginning of the century, many voices had called for the creation of such an institution, to give Crédit Agricole more autonomy and greater flexibility. It was thus that the Office National du Crédit Agricole was established by the law of 5 August 1920. This was renamed the Caisse Nationale de Crédit Agricole in 1926, mainly to ensure consistency between the names of the three levels (local, regional and national ‘caisses’). The CNCA became Crédit Agricole S.A. when it was listed in 2001.

At the same time as this restructure, Crédit Agricole widened its scope of activity, particularly in boosting agricultural production and financing reconstruction initiatives. A law allowed Crédit Agricole to grant loans to small rural tradesmen: this was the result of a concept of agricultural development born before 1914 that began to talk more in terms of the countryside than of peasantry. This movement was reinforced in 1923 as a law was voted in authorising Crédit Agricole to grant loans to local authorities for rural electrification and to combat urban migration.

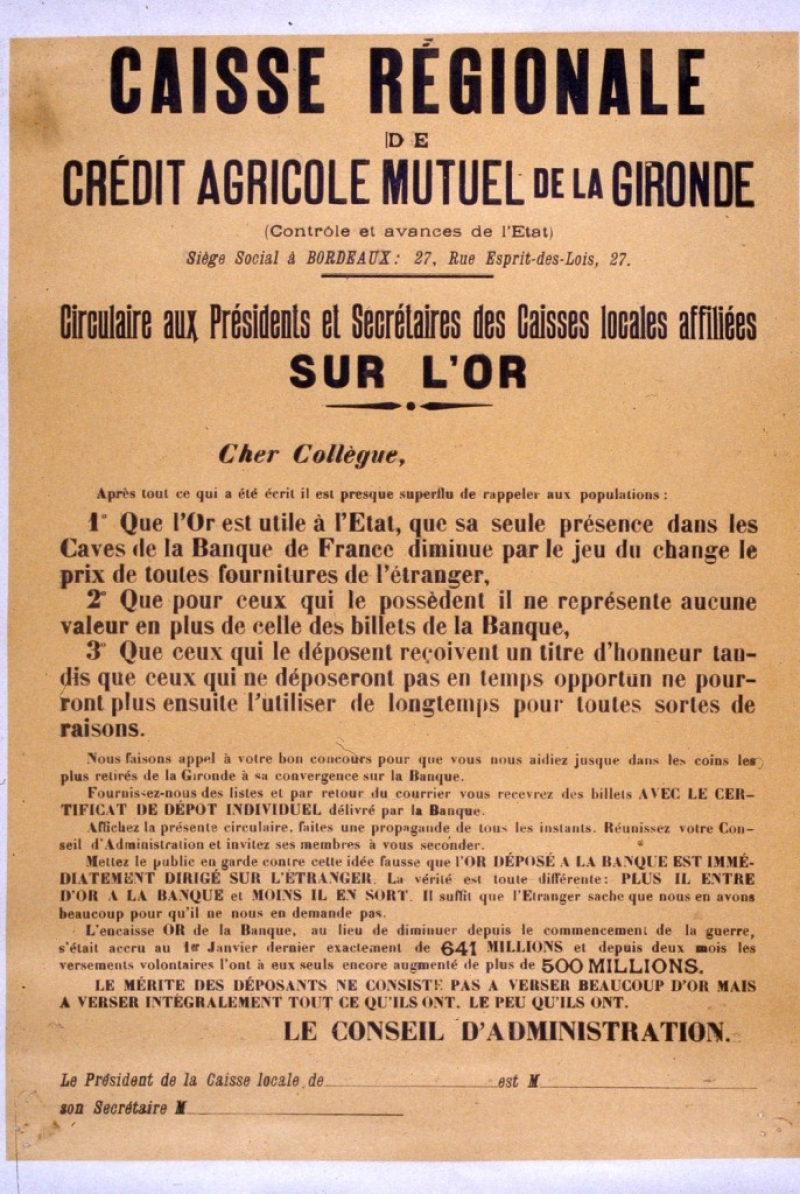

In addition, a movement that had begun during the war continued: farmers began to entrust their money to the regional banks, as a result of the State's appeal for gold to be deposited with credit institutions.

Click on the image to zoom in

It was these initial extensions to its areas of expertise and this increase in deposits that enabled Crédit Agricole to begin its transformation, which would take several decades, into a fully operational banking institution.