- #Customer relation

- 2019/11/27

- 0

-

13

Excellence in customer relations: a tailored five-year post-secondary course for Crédit Agricole

Expertise-building and skills certification in a unique professional training programme: this is the opportunity offered starting this year to experienced business customer advisers in the Regional Banks, LCL and the subsidiaries. This qualifying course, co-branded with IFCAM-ESCP, meets the demands of a profession that is growing more complex and is fully in line with the Group Project and the 2022 Corporate Trajector.

Focusing on excellence in customer relations

The brand-new Master’s aims to support Business Customer Advisers already working with the company to help them become the preferred bankers of small- and mid-cap senior executives. Objective: offer a unique experience in customer relations based on tailored advisory services, relevant offers and the capacity to deliver our services from end to end at a high operational level. In a highly competitive market impacted by regulatory and technological changes that are fragmenting customer relations, the course aims to strengthen the technical expertise required while focusing on approach and advisory services.

For Jean-Claude Mazza, Deputy CEO of the Centre France Regional Bank and sponsor of the “skills building” pillar of the 2022 Corporate Trajectory:

“This tailored training course, which reflects our values, is fully in line with the new customer relations model that will allow us to stand apart vis à vis our customers on this market. To this end, we must work on improving our performance as well as our capacity to develop quality digital customer journeys. This is how we will become a global player capable of meeting all our customers’ needs, no. 1 in the Customer Recommendation Index and the reference in retail banking.”

Jean-Claude Mazza, Deputy CEO of Crédit Agricole Centre France, sponsor of the project, and mentor for the first cohort

Business customer advisers play a pivotal role in the relationship with companies and senior executives

Approximately 800 Business Customer Advisers work in the Regional Banks and 150 at LCL. They are generally dedicated to a customer base segmented by revenue and/or business sector.

They manage and develop a portfolio of corporate customers (MSE and SME) while supporting the implementation of their projects. They identify customers’ needs and offer them tailored solutions with the support of the Group's experts (financing, international transactions, payments, investments, employee savings, insurance, etc.).

Benoit Passaga, Head of Corporate Markets and the Public Sector at Crédit Agricole S.A., notes that “support at key moments in the life of the company, knowledge of the business sector, proactiveness, and useful advice are among the key expectations of our current and prospective customers that our business customer advisers must meet.”

Why create a Business Customer Advisory Master’s?

The corporate market is the highest rated segment for the Regional Banks in terms of the Customer Recommendation Index, which has been positive since 2016. Thanks to many initiatives undertaken, our strengths in customer relations, as perceived by our customers, are accessibility, support in terms of financing, advisory and the networking of our expertise.

A comprehensive course with a high level of instruction

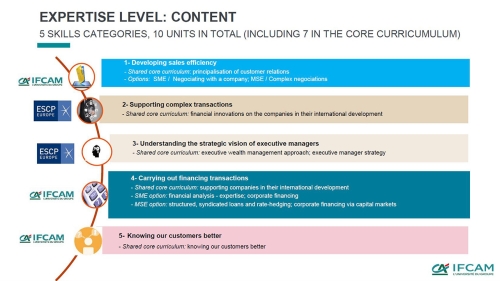

This Master’s, co-branded by IFCAM-ESCP Europe, was co-constructed with the business lines of the Regional Banks and LCL, Crédit Agricole S.A. and the FNCA. The specifications are based on a set of key activities and skills expected by customers and specific to Crédit Agricole Group: customer-centric approach and social skills, a high level of technical knowledge, understanding of risks specific to companies, innovation in the area of financing, and international development.

The course is aimed at experienced Business Customer Advisers (minimum three years’ seniority) and offers two specialisations: small- and mid-size enterprises (SME) and medium-sized enterprises (MSE).

Structured around five skills areas for a total of 16 classroom days, it is being deployed in the regions, in Montrouge at the IFCAM offices and in Paris at ESCP.

100 employees of the Group - from 35 Regional Banks and LCL, Foncaris and CA Ukraine - already completed the course in 2019.

A genuine “Play Group”!

The registration period for the third cohort is underway with a start date in mid-January 2020.

Find out more:

laetitia.salmon@credit-agricole-sa.fr; pascal.cathalifaud@ca-ifcam.fr