- #Group Project

- 2020/01/09

- 0

-

9

Credit Agricole CIB 2022 Medium Term Plan

In line with the Group Project and the 2022 Medium Term Plan, Crédit Agricole CIB has announced its strategy and goals for 2022.

Leveraging a client-focused model, expert teams and a strong social commitment, the strategy aimed to make Crédit Agricole CIB the trusted finance and investment partner for the Group’s clients all over the world.

« Crédit Agricole CIB is a strong and profitable corporate and investment bank with a model which has been successfully transformed ten years ago: an expert bank, a long-term partner of Corporates.”

Jacques Ripoll, Chief Executive Officer

An uncertain environment

In an increasingly competitive market context, faced with regulatory pressures and a fast-changing technological environment, Crédit Agricole CIB must continue with its transformation. The 2022 Medium Term Plan is designed to meet these challenges.

I/ Ambitious goals supported by a resilient and profitable model

Cliquez sur l'image pour zoomer

* RWAs: Risk-Weighted Assets.

** RoNE: Return on Normalised Equity.

II/ These ambitious targets are underpinned by strategic choices: to be more focused on financing activities and Corporate customers, supported by an extensive and highly coordinated international network.

Three are supported by 3 initiatives:

1. A confirmed customer and international strategy, powered by growth in the Asia-Pacific region

Crédit Agricole CIB has decided to combine its Coverage and Investment Banking businesses within a single global reporting line that now has over 330 Senior Bankers and 220 Investment Bankers.

This integrated model provides for greater agility in global resource allocation, allowing the business to serve almost 4,000 customers. The aim is to boost value creation for the Bank.

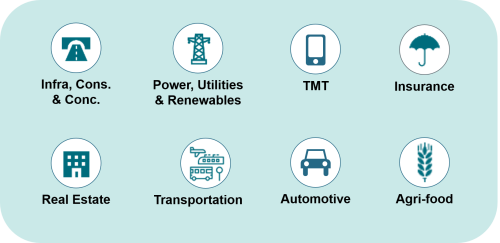

Crédit Agricole CIB has adopted a sector-based approach focused on eight differentiated sectors: infrastructure, construction and concessions; electricity, utilities and renewables; technology, media and telecommunications (TMT); insurance; real estate; transport; automotive; and farming and agri-food.

Cliquez sur l'image pour zoomer

Thanks to its global presence, the bank is able to help its major customers with their international transactions. Crédit Agricole CIB’s ambition is to grow revenue from the Asia-Pacific region, which is becoming the Bank’s leading growth driver, especially in China.

Cliquez sur l'image pour zoomer

2. Expertise in structured finance and serious ambitions in commercial banking

Crédit Agricole CIB has historically been a leading player in financing real assets.

Its aims in financing activities are to:

- maintain its leadership in financing real assets;

- support growth by continuing to promote high value-added solutions (with revenue growth in the Acquisition Finance and Advisory business averaging 6% a year);

- strengthen distribution capacity through a unified global platform;

- accelerate the development of transactional commercial banking, which is set to account for around 25% of Crédit Agricole CIB’s revenue growth between now and 2022.

3. Capital market activities that complement our financing activities, with higher profitability targets

The new organisational structure of capital market activities reflects customers’ needs and covers both market financing solutions (credit and securitisation) and hedging and investment products.

The ambition is to grow revenue from market activities to around €2 billion by 2022. Direct costs will be cut by around 10% over the same time horizon by optimising processes and procédures.

III/ Three fundamental transverse levers to support our strategy

To deliver on its Medium Term Plan, Crédit Agricole CIB is pursuing three cross-functional initiatives in the areas of sustainable finance, digital technology and innovation, and the workforce.

1. A renewed strong commitment to green and sustainable finance

Crédit Agricole CIB is a global leader in green and sustainable finance. The Bank wants to remain in the global top five and expand its range of innovative sustainable development-focused solutions to all its business lines.

It is also keen to take its commitment to sustainable finance further by aligning its sector-specific policies with the International Energy Agency’s Sustainable Development Scenario, in keeping with the Paris Accord goals.

“Green and sustainable finance is our field of choice. We aim to double the size of our green finance portfolio by 2022.”

Jacques Ripoll, Chief Executive Officer

2. Data: at the heart of our long-term digital strategy

Crédit Agricole CIB makes its data project a central component of its long-term digital strategy.

It has an innovation team reporting directly to the Chief Executive, with a clear mandate to support and coordinate business lines through their digital transformation, boost innovation and lead the three-year data project.

› Read about the project in detail

3. Our people, our strength

The Bank’s ambition is to build the future by investing in its teams and onboarding new generations so as to promote expertise, skills diversity and shared knowledge.

The Bank is also keen to strengthen employee engagement by launching an empowerment approach that will enable all staff to make full use of their talents and play an active role in the Group’s transformation.

The aim is also to explore new ways of working designed to help foster entrepreneurial thinking and make the corporate culture and inclusion central planks in the development of our business lines.

“Our people are our strength, Crédit Agricole and Crédit Agricole CIB have chosen to place people at the heart of the strategy as an asset and a lever to reach our ambitions."

Anne-Catherine Ropers, Human Resources Director