-

View article

#Economy

#EconomySouth Korea: a year after the political crisis, markets are buying the promise of stability

2025/12/17 -

View article

#ACT2028

#ACT2028Olivier Gavalda, Chief Executive Officer of Crédit Agricole S.A., explains ACT 2028

2025/11/18

Key figures Crédit Agricole S.A

2nd half 2025

Crédit Agricole S.A.'s Article of Association on 13th November 2025

Publications 1st half 2024

2nd half 2023

Crédit Agricole S.A.’s Articles of association at 13 January 2023

Capital allocation at 31 December 2022

Crédit Agricole S.A.’s ownership structure enables it to approach development with a view to long-term value creation.

Together, the Regional Banks have long-term control over most of Crédit Agricole S.A.’s capital via SAS Rue la Boétie. This stable ownership structure enables Crédit Agricole S.A. to pursue a long-term policy of sustainable, profitable growth.

Financial highlights

Crédit Agricole Group consists of Crédit Agricole S.A., the Local Banks and the Regional Banks and their subsidiairies.

| 2022 | Crédit Agricole Group | Crédit Agricole S.A. |

|---|---|---|

Shareholder's equity Group share (Bn €) | 126.5 | 64.6 |

Revenues (Bn €) | 38.1 | 23.7 |

Underlying Net income Group share (Bn €) | 8.1 | 5.5 |

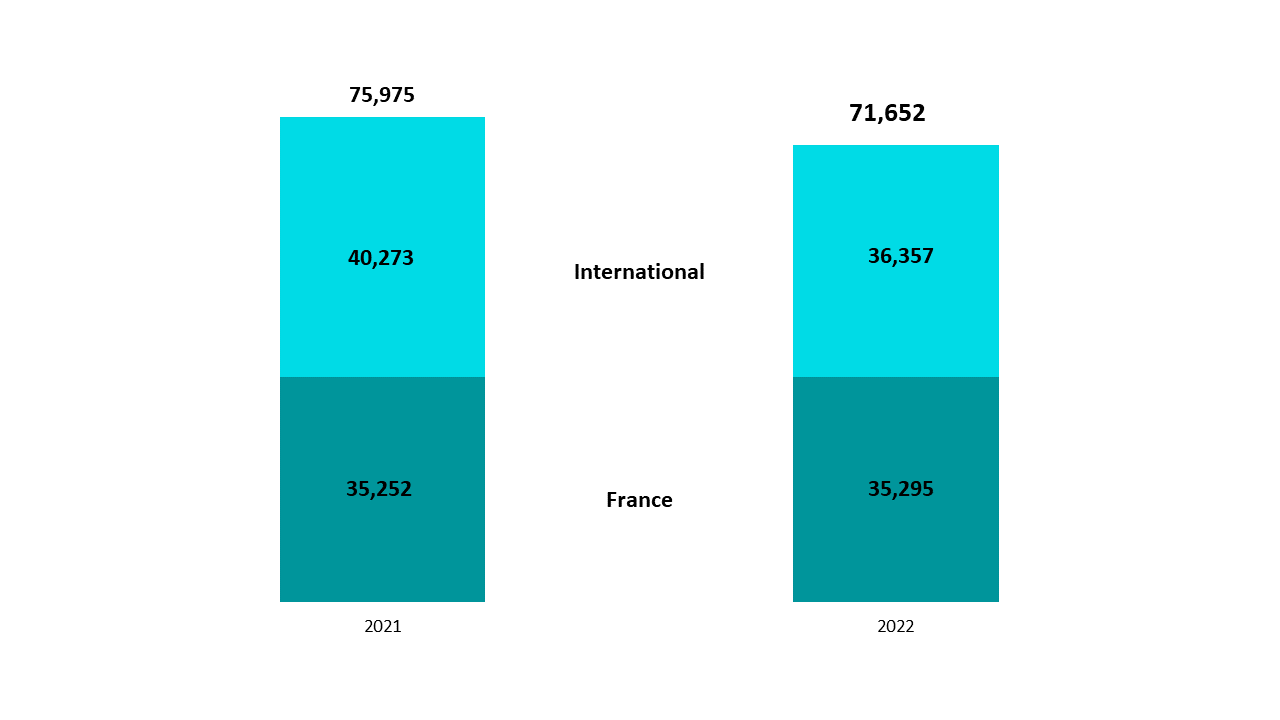

Crédit Agricole S.A.’s main indicators

| Millions of euros | 2022 underlying | 2021 underlying |

|---|---|---|

Revenues | 23,733 | 22,651 |

Gross operating income | 9,264 | 9,047 |

Cost of risk | -1,551 | -1,232 |

Equity-accounted entities | 379 | 368 |

Net income | 6,331 | 6,273 |

Net income Group share | 5,468 | 5,397 |

Earnings per share | €1.69 | €1.69 |

Contribution of business lines

Contribution to net income Group share (in m €)

| Millions of euros | 2022 Underlying |

|---|---|

Asset gathering | 2,415 |

French retail banking - LCL | 875 |

International retail banking | 411 |

Specialised financial services | 767 |

Large customers | 1,709 |

Corporate center | -708 |

Total | 5,468 |