Crédit Agricole S.A.‘s ambitions for 2025

2025 Ambitions, Crédit Agricole S.A.'s medium-term plan for 2025.

An unprecedented context, clear ambitions

The period ahead of us is unique: the “medium term” in no longer observable. It has made way for a “short term” horizon that is particularly opaque under the combined effects of multiple crises and a true “long term” which has never been so clearly expressed by politicians and public opinion, the decarbonisation of energy, the protection of biodiversity and the environment, healthcare solutions for increasingly ageing populations, necessary technical progress in agriculture and agri-food and social inclusiveness which is essential for the stability of our societies.

Overall, with 2025 Ambitions, Crédit Agricole S.A. is part of this paradigm in which it is easier to think long-term than to predict short-term.

Our road map remains clear: helping all of our customers and regions through situations that may be very difficult in the short term, and making a commitment as the facilitators and accelerators of all of these social transitions and acting for tomorrow.

Our historic business model, which combines Utility and Universality, and our DNA as a committed player in the major social transitions will allow us to achieve these targets.

- Our 2025 trajectory is one of amplification : thanks to strong organic growth potential, we target over one million additional customers for Crédit Agricole Group. Our business lines are leaders in Europe and will continue their development and expand their offers to answer changing needs and to support transitions.This Plan aims to generate, for Crédit Agricole S.A., net income Group share of more than €6 billion and strengthen profitability, which is already among the best in Europe, with a return on tangible equity of more than 12%.

- In the long-term, 2030 and beyond, the Group is restructuring and is launching two new business lines that are useful for society and offer growth opportunities. We are launching Crédit Agricole Transitions & Energies to make energy transitions accessible to all and accelerate the advent of renewable energy. We are launching Crédit Agricole Santé & Territoires to facilitate access to healthcare and to ageing well across all regions.

A Group that is ready to face short-term challenges thanks to the strength of its model

Steady growth momentum for our model based on a winning combination: Social usefulness and Universality.

Social usefulness was the driver for Crédit Agricole being created in 1885 in Salins in the department of Jura

This usefulness is our determination to act in the interest of society as a whole, to make progress accessible to all and to support and major societal transformations as needs evolve. This has always been a guiding force for Crédit Agricole.

Click on the image to enlarge it

Universality means being useful to as many people as possible

Crédit Agricole has chosen to provide a service to both the least and most well-off, to micro-enterprises and to large international corporates, across all regions and channels.

It is the combination of social usefulness and universality that has allowed us to create a Bank focused on global and sustainable relationships with the largest customer base in Europe, putting competitive and innovative business lines at their service.

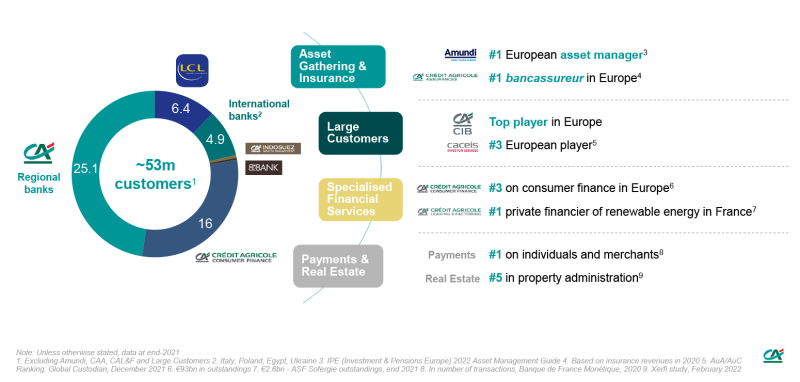

These business lines enjoy strong and complementary growth momentum thanks to their leading positions on each of their markets.

Leading business lines at the service of all Group customers, also pursuing their own growth dynamics

a strong direct-customer base, served by business lines that are leaders and consolidators in their markets - Click on the image to enlarge it

We have the capacity to increase our growth organically by 2025

High organic growth potential across all of our markets and a target of more than one million additional customers for Crédit Agricole Group by 2025.

- Our target is to win more than one million customers (net) by 2025.We also aim to improve customer equipment in terms of protection insurance, savings solutions, real estate etc.

We will broaden our current products and services and adapt them to meet a new range of needs, making them more accessible, more responsible and more digital. - In addition to this organic growth momentum, we expect to establish new partnerships with financial players and industrial leaders and will develop technological partnerships.

- Through targeted acquisitions, we aim to strengthen our positions on our domestic markets and will develop our international activities with a focus on Europe, in line with our profitability criteria.

Our targets and priorities by entity:

- Crédit Agricole Payment Services

- Crédit Agricole Leasing & Factoring

- Crédit Agricole Consumer Finance

- Crédit Agricole Assurances

- Crédit Agricole Brie Picardie

- Crédit Agricole Corporate & Investment Bank

- Crédit Agricole Immobilier

- CACEIS

- LCL

- Amundi

- Indosuez

- BforBank

- Blank

- CA Italia

- CA Egypt

- CA Ukraine

- In the presentation, see details of our targets and priorities by entity, pages 17 to 25

The development of all our business lines will be stepped up, particularly the Group’s cross-divisional business lines such as Payments and Real Estate, as well as technological services.

- We are the leader in France in Payments for individual customers and retailers and will continue to grow with more offers and services. We aim to increase our revenues by 20% by 2025.

- In real estate, we intend to integrate real estate offers within our advisory role at all of our banks. This major driver will help us benefit from synergies between our banking and real estate activities to significantly increase our market share, with the addition of renovation offers.

We will also launch a green real estate entity. - We are stepping up our investments in digital banking for individual customers and professionals.

- We are developing our “technology as a service” technological platforms.

This growth driver for the Group will draw on our leading business lines and technological partnerships.

Two targets have been set: enhance the growth of existing platforms and open up new technological platforms to the market. Tangible examples are already in operation and gaining pace: Azqore, the wealth management platform, is targeting assets under management in excess of €240 billion by 2025. Amundi Technology, the IT platform for the savings industry, has a revenue target of more than €150 million for 2025.

Achieving our ambitions is based on a digital relationship-based model which is enhanced by human responsibility, with fully digital key customer experiences (¾ of customers using digital channels in 2025) … driven by technological capacity and the ability to innovate (a €20 billion IT & digital budget over the period), and the continuation of organisational streamlining and managerial transformation.

- In the presentation, see details of our businesses and technological services, pages 26 to 30

An overview of Crédit Agricole S.A.’s financial targets: ambitious growth and enhanced profitability

Ambition 2025 targets ambitious growth.

This is notably made possible by accelerating our technological, digital and human transformation. To this end, we are allocating around €20 billion to IT and digital sending over the period, including €1 billion for technological transformation investment programmes.

For Credit Agricole S.A., this Plan aims to produce a net income of more than €6 billion., and to strengthen our profitability, which is already among the best in Europe, with a return on tangible equity of more than 12%.

The 50% cash pay-out policy will allow us to strike the right balance between attractive remuneration for shareholders and financing of the Group’s growth.

- In the presentation, see details of our key success factors, pages 31 to 38

- In the presentation, see details of our 2025 financial targets, pages 39 to 48

In the longer term, from 2030 onwards, we will continue our climate strategy and commitment to major societal challenges

Our climate strategy is a long-standing commitment at the heart of our Societal Project.

We will continue our efforts with a commitment to contributing to carbon neutrality by 2050.

In practice, in addition to our achievements since 2019, we will publish in 2022 and 2023 our decarbonisation strategies for our portfolios in 10 economic sectors representing 75% of global emissions and around 60% of our assets under management.

These strategies will be framed by short-, medium- and long-term action plans and will provide significant support to renewable energy and carbon-free mobility as well as to new green sectors and technologies.

We have already made a number of commitments to decarbonising our sector portfolios. In line with the International Energy Agency’s NZE scenario, the carbon emissions associated with our financing activities in the Oil and Gas sector will fall by 30% between 2020 and 2030. Over the same period, we will reduce the carbon intensity of our lending to the automotive sector by 50%. Our direct carbon footprint will also be halved by 2030.

From 2022, the Group is committed to ceasing all financing for new projects that are directly related to unconventional hydrocarbons, and for new oil or gas projects in the Arctic.

Our DNA as a committed player supporting societal transitions has resulted in our desire to create two new business lines which will be useful to society and drive growth opportunities:

- The new business line Crédit Agricole Transitions & Energies will support energy transitions.

Crédit Agricole Transitions & Energies will enable us to accelerate and consolidate the implementation of our climate strategy.

We will be able to support our customers throughout their journey, from assessment and advice to the completion of their road map, via the interim stages of installing and financing innovative infrastructure and equipment and creating new business models.

With the help of Crédit Agricole Transitions & Energies and the experience acquired by the Group from over 20 years of financing renewable energy, Crédit Agricole will provide a huge boost to investments in this area, prioritising strategic partnerships and short production chains. This will allow us to support our own installation and use of energy production equipment as well as that of third parties. Crédit Agricole Transitions & Energies will also roll out green energy offers to Group customers. - The new business line Crédit Agricole Santé & Territoires will facilitate access to healthcare.

We are expanding access to care across all regions (developing telemedicine, supporting new forms of medical practice, rolling out healthcare facilities in medical deserts etc.).

We will also make it easier for people to age well, both in their own homes (through a new support platform) and in terms of housing (expanding the pool of senior housing options).

In this respect, we will make use of different Group initiatives, partnerships and a strong growth in the health insurance policyholder base.

See also:

2025 Medium-Term Plan:

• See the 2025 Ambitions press release of Crédit Agricole S.A.

• Access to the live of the investor day "2025 Ambitions"

• Download Crédit Agricole S.A.'s 2025 Ambitions presentation

• Read the document "MTP Digest"

2022 MTP:

• Our strategic positioning (2022 MTP)

• Our vision (2022 MTP)