-

View article

#Financial publications

#Financial publicationsInterview with Clotilde L’Angevin - Significant full-year earnings and a transitional fourth quarter marked by the launch of the new MTP

2026/02/04 -

View article

#Financial publications

#Financial publicationsInterview with Olivier Gavalda - Results that reflect teams’ commitment to serving our customers and society

2026/02/04 -

View article

#Economy

#EconomySouth Korea: a year after the political crisis, markets are buying the promise of stability

2025/12/17

History of the Crédit Agricole group

Development driven by the interests of our customers and society

Originally conceived to support and develop France’s agricultural sector, Crédit Agricole has had to overcome many challenges in the course of its history. This series of films tells the story of four of them.

-

Agricultural lending in the late 19th century

At the end of the 19th century, farmers struggled to obtain suitable loans. The 1884 Act on professional freedom of association authorised the formation of farmers’ unions and created an environment conducive to the emergence of suitable organisations: in 1885, a local initiative by Louis Milcent and Alfred Bouvet gave birth to Société de crédit agricole de l’arrondissement de Poligny in Salins-les-Bains (Jura), the first organisation of its kind.

-

1894 : Crédit Agricole is officially born

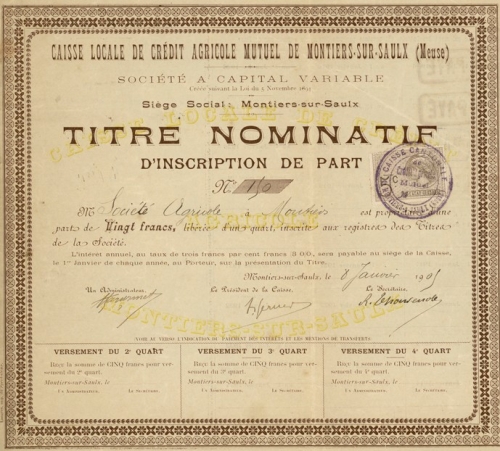

To support small family farms and attract farmers’ votes, the Third Republic passed the Act of 5 November 1894 authorising members of farmers’ unions to establish local agricultural lending banks for which they would be liable, in keeping with the principle of mutuality. The government drew inspiration from the Salins-les-Bains model. These local banks are the foundation of the institutional “pyramid” erected by Crédit Agricole.

Jules Méline (1838-1925) was a member of parliament and subsequently senator for the Vosges region for nearly 50 years, during which he held a number of ministerial positions. He was behind the 1894 Act establishing agricultural lending banks.

Registered member share of the Montiers-sur-Saulx (Meuse) Local Bank, 1905. Governance of the Local Banks was organised democratically based on the principle of one man, one vote, irrespective of the number of shares held.

-

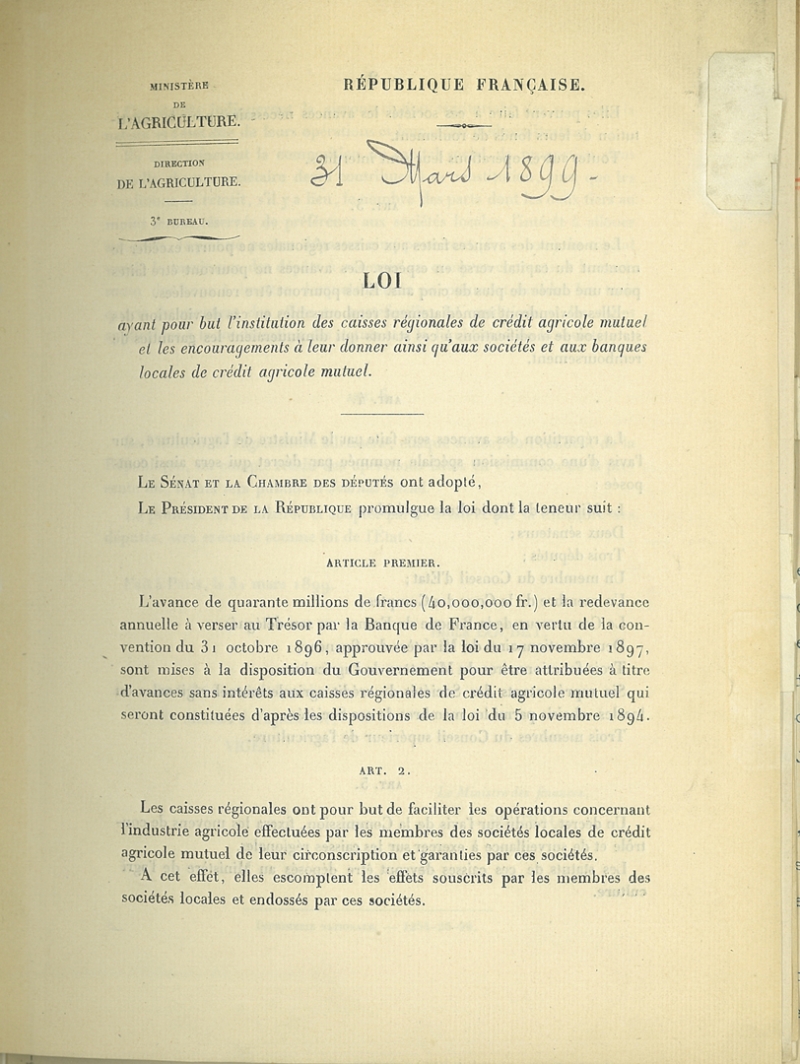

Government support and creation of the Crédit Agricole Regional Banks

The 1894 Act conferred no particular financial advantages on Local Banks, which quickly found themselves running out of capital. In 1897, the government ordered the Banque de France to provide Crédit Agricole with funding in the form of an endowment of 40 million gold francs and an annual payment of 2 million gold francs. These advances were apportioned by an Agriculture Ministry committee, and the Act of 31 March 1899 authorised the creation of the Crédit Agricole Mutuel Regional Banks. This is the second tier of Crédit Agricole’s institutional “pyramid”.

-

1900-1919: Rise of the Local and Regional Banks

During this period, Local and Regional Banks proliferated thanks to a proactive advertising campaign: by the time of the First World War, every département had at least one Regional Bank. Despite being authorised to offer long-term loans, these banks continued to mainly lend over short term. Although deposits were growing, the government still provided three quarters of the Banks’ funding. Starting in 1906, Crédit Agricole was authorised to grant loans to agricultural cooperatives.

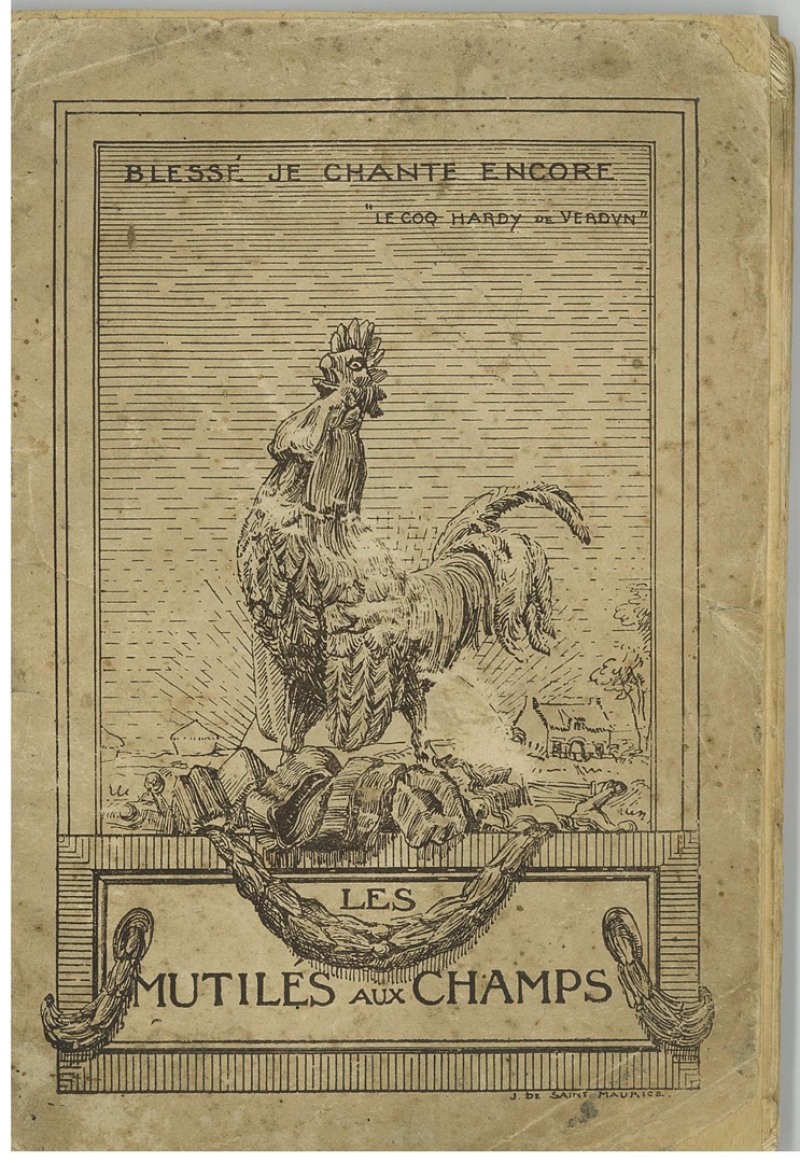

The First World War severely disrupted operations, highlighting the need for a central bank to regulate the overall organisation. Crédit Agricole was nevertheless called upon to finance the redevelopment of derelict land and restore farms located close to the front line. It was also called upon to extend preferential loans to disabled ex-servicemen and civilian casualties to enable them to buy, develop or restore small rural properties.

-

The Act of 5 August 1920 and establishment of the Office National du Crédit Agricole

The Act of 5 August 1920 established the Office National du Crédit Agricole, giving greater autonomy to what had previously been no more than a department of the Ministry of Agriculture and creating a central clearing organisation for the Regional Banks. In 1926, this central clearing organisation was renamed Caisse Nationale de Crédit Agricole (CNCA). This public sector institution sits atop Crédit Agricole’s institutional “pyramid”.

The Act of 5 August 1920 significantly expanded the scope of Crédit Agricole’s activities. Membership was opened up to the whole of the agricultural sector, from major absentee landowners all the way down to farm hands. No longer was it necessary to be a member of a farmers’ union; small rural tradesmen could also apply for loans.

Cover of the booklet of the Act of 5 August 1920

Staff at Caisse Nationale de Crédit Agricole in 1929

-

1920-1945: First steps beyond the agricultural world

In the 1920s, Crédit Agricole expanded its geographical footprint and made its first forays into new areas of business, extending loans to small rural tradesmen, financing rural electrification in 1923, granting the first home loans to farmers of limited means in 1928, and so on. These various activities helped improve rural quality of life and thus slowed the exodus from rural to urban areas.

However, the Local and Regional Banks did not emerge unscathed from the 1930s crisis. The most exposed were supported by CNCA, which stepped up its supervisory activities. A joint deposit guarantee fund was set up in 1935.

Although the Vichy regime strengthened state control over Crédit Agricole, this was only a temporary state of affairs. However, the institution underwent a major financial transformation during the period: Crédit Agricole issued its first five-year notes, funnelling rural savings to the Treasury.

1930s poster

Five-year note with a par value of 1,000 francs, dated 1942

-

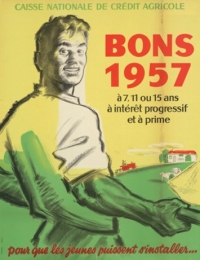

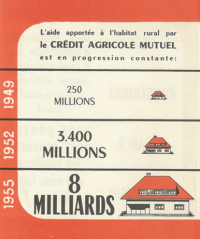

1945-1966: Post-war reconstruction and modernisation

Crédit Agricole opened many new offices, gradually extending its coverage across the whole of France. Its extensive network enabled it to offer access to banking services to the entire population. With five-year bonds boosting deposits, Crédit Agricole was able to help finance post-war reconstruction and agricultural modernisation. No longer reliant on state subsidies, it was fully self-financing from 1963 onwards.

Promotional Fédération Nationale du Crédit Agricole (FNCA) blotter (1950s). FNCA was set up in 1945 as an association to represent the Regional Banks in their dealings with the public authorities and CNCA. It was revamped in 1947 and would play a key role in training staff and extending Crédit Agricole’s areas of expertise.

-

1966-1988: Towards a universal bank

In 1966, Caisse Nationale de Crédit Agricole became financially independent, with deposit inflows no longer passing through the Treasury. In the 1970s, Crédit Agricole continued to expand into new areas, both geographically and financially. The Bank also established its first subsidiaries to offer its services to more sectors (agri-food, SMEs and SMIs, etc.).

Known as a bank for homeowners, its close relationship with customers was underscored by its new advertising strapline, Le bon sens près de chez vous (“Common sense close to home”), launched in 1976.

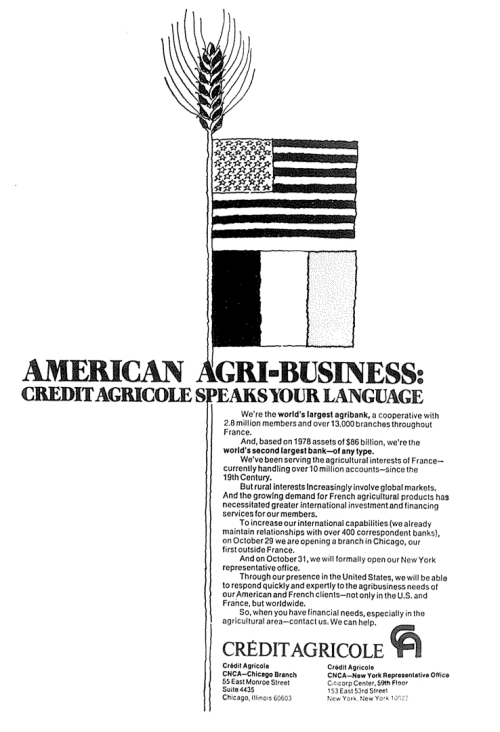

It was also at this time that Crédit Agricole began to expand internationally, opening a branch office in Chicago in 1979.

Lastly, the Group also diversified its business into the insurance sector, establishing Predica in life insurance (1986) and Pacifica in property and casualty insurance (1990). It quickly became one a leading player in the sector.

1979 advertisement in the Chicago Tribune to mark the opening of the Chicago branch office.

-

1990s onwards: From institutional transformation to the formulation of CA’s raison d’être

The 1988 Privatisation Act enabled Crédit Agricole’s Regional Banks to acquire CNCA, which became a public limited company completely independent from the state. It was listed on the stock market in 2001 under the name Crédit Agricole S.A.

This major step forward enabled Crédit Agricole to expand and diversify by acquiring companies in investment banking (Banque Indosuez in 1996) and consumer credit (Sofinco in 1999 and Finaref in 2003). Following the 2003 tie-up with Crédit Lyonnais, various business lines were combined to give birth to Crédit Agricole Corporate and Investment Bank in 2006. Crédit Lyonnais refocused on retail banking and rebranded as LCL in 2005.

Asset management subsidiary Amundi was created in 2010 and quickly became the leading player in its sector.

In 2019, Crédit Agricole drew on its history, its universal banking model and its role as the leading financer of the French economy to formulate its raison d’être: “Working every day in the interest of our customers and society”.

2001 poster promoting the listing of Crédit Agricole S.A.

2020 corporate identity film.