Benchmark rates reforms, after launch of the €STR

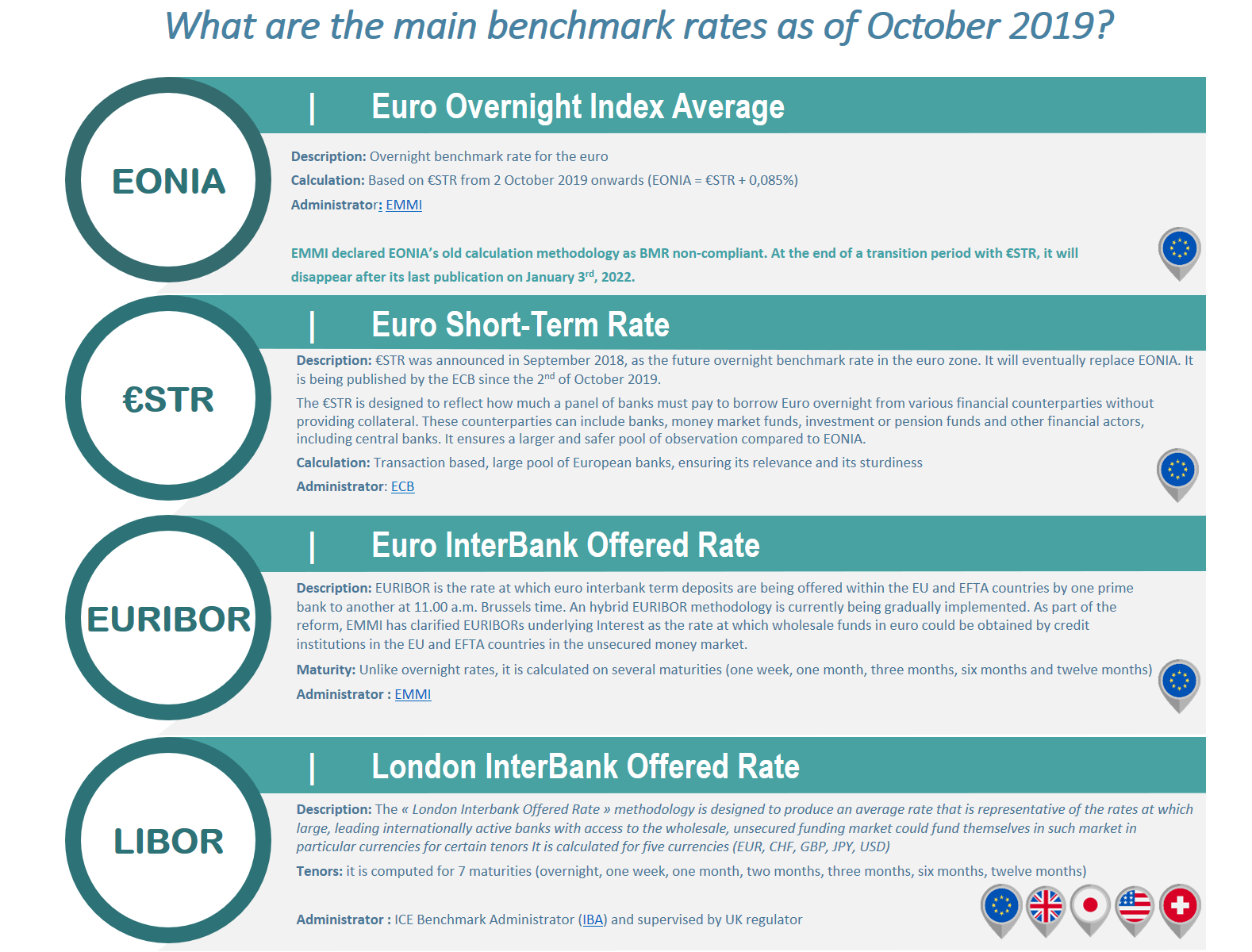

The €STR was established on 2nd October 2019. This new benchmark is conceived to permanently replace the EONIA by 2022. This first step in Europe is the result of a worldwide initiative starting in 2013 and expressed within the European Union and EFTA (European Free Trade Association) countries by the BMR (Benchmarks Regulation). In order to meet the requirements of €STR as from the 2nd of October and support all its clients, both individuals and companies, in this transition toward new benchmark rates, Crédit Agricole has launched the Benchmarks project, which coordinates the incremental steps of the transition within the Group as a whole.

This report assesses the status of these reforms today, which have numerous impacts, both in France and internationally.

What is a benchmark rate?

A benchmark rate is a regularly published figure calculated by a formula based on the value or price of one or more underlying assets. A rate is considered a benchmark when it is used to:

• calculate the interests rate to be paid with regard to a financial instrument or contract (e.g. certain real estate loans or bank overdrafts);

• determine the value of a financial instrument;

• measure the performance of an investment fund in order to replicate the performance of that benchmark;

• define the asset allocation of a portfolio;

• calculate a fund's performance fees.

Why are benchmark rates important?

They are widely used throughout the economy in financial transactions or for accounting purposes by companies and banks in order to calculate, for instance, the value of their financial assets. They can also be used to calculate the remuneration of deposits or overdraft fees for individuals. In France, EONIA is also used in calculating Livret A returns.

Benchmark rates are also essential for central banks since they enable a better grasp of financial markets and liquidity conditions.

What is the reason for these benchmark rates reforms?

Commonly known as "IBOR reforms", these reforms followed the recommendations of the IOSCO (International Organisation of Securities Commissions) and the FSB (Financial Stability Board). These recommendations arose in the first place from a decrease in the number of contributors to the panel and the scarcity of liquidity in Interbank markets. The latter resulted in a significant fall in underlying transactions volumes and a weakening of the main benchmarks rates and underlying transactions.

In addition, political authorities and regulators wanted to create a strong impetus to better protect the financial system, clients and investors, and to strengthen the reliability of benchmark rates by shedding light on their governance and adopting more transparent calculation methods.

In Europe, this reform takes shape under the EU Benchmarks Regulation (BMR) published in 2016 and unforceable since the start of 2018. It should be noted that the BMR applies to all asset classes and not just fixed income markets. It reinforces the obligations of administrators, contributors and benchmark users.

Who are the actors involved in these reforms?

The banking sector and, more generally, the private sector has been organising to implement the changes demanded by the reforms. All banks, including Crédit Agricole Group, have been particularly active by participating in working groups in the main financial centres. These initiatives received the support of authorities and regulators.

In that respect, in Europe, the Euro Risk Free Rates Working Group is composed of credit institutions selected by four public institutions, including the ECB and the European Commission. Its goal is to identify and recommend alternative benchmarks to current reference rates (such as EONIA) that are used in a wide range of financial instruments and Eurozone contracts. These alternative solutions require in certain cases the definition of transition plans or the identification of benchmarks that can be used as substitutes.

The ECB provides the support of this Working Group, participates as a simple observer and disseminates its recommendations. Providing they are not laws, these recommendations are not enforceable. Certain central banks become administrators of critical reference rates for the financial system. For example, it is now the ECB that administrates, calculates and publishes €STR.

Clients and the private sector as a whole are also important actors within these reforms since they play a major role in the adoption of these new benchmarks."

What are the challenges of these reforms?

Firstly, guidelines and early decisions diverge, both in terms of the methodology for calculating Risk Free Rates and in the defining of alternatives to IBORs. In addition, transition calendars are not synchronised.

Then, the legal complexity. Any modification in the transactions must be incorporated into the contracts for parties that have entered a formal contractual agreement. The existence of sufficiently robust fallback clauses anticipating the waterfall of suitable alternatives in the event of the permanent discontinuation of benchmarks is essential for carrying out the required transitions. If these clauses are not included in the contracts or are not deemed robust, they must be included or amended as soon as possible by means of protocols, such as on the derivatives market, or bilaterally for financing transactions. This repapering exercise must be carried out primarily for contracts with maturities beyond the date on which the mentioned benchmark would cease to apply.

Lastly, there is the wide scope of the reforms. Its impacts are indeed very numerous, given the massive use of benchmark rates in the economic and financial system. Benchmarks reforms therefore represent a substantial operational challenge for banks and their clients. For example, the recalibration of EONIA (date of publication from T to T+1) has required significant groundwork.

Which are the main stages of these reforms?

The reforms stem from recommendations by the International Organisation of Securities Commissions (IOSCO) in 2013 and by the Financial Stability Board (FSB) in 2014 with the aim of sustainably strengthening benchmarks. Alternative Risk Free Rates were defined on this basis.

In Europe, under the BMR, the transition period is set to end on 31/12/2019 for noncritical european benchmarks (EEA) and on 31/12/2021 for both critical and third country benchmarks (outside the EEA). After these dates, the use of benchmark rates that benchmark rates supervised by administrators that have not been registered as “authorized” on the ESMA register will no longer be permitted.

During the transitional period, from 2nd October 2019 to 3rd January 2022, EONIA continues being published, its calculation method becomes "EONIA = €STR + 0.085%" and its publication takes place on T+1 at 9:15 am (instead of the current T at 7:00 pm CET), on the day following the day of the transactions it reflects. The 0.085 spread between EONIA and €STR, calculated and published by the ECB, was established in order to guarantee the equivalence of EONIA, before and after 2nd of October, 2019. It will remain fixed until the last EONIA publication on 3 January 2022. After 3 January 2022, €STR will become the only overnight reference rate for the euro.

The discontinuation of the LIBOR rates in particular is expected by the end of 2021. Indeed, the British regulator has announced that by this date the contribution of banks to panels would no longer be mandatory.

What is Crédit Agricole Group doing to prepare for this and support its clients?

The Group has had a substantial input in preparing the transition, particularly in Europe through the ECB Euro Risk Free Rates Working Group ("ECB EUR RFR WG"). Crédit Agricole also supervised the efforts that allowed for the issuance of recommendations on the EONIA-€STR transition, while carefully monitoring other international Working Groups progress.

The Benchmarks project is steered at the Group level and is carried out in each entity, with the aim of:

• identifying relevant exposures (products, contracts, processes);

• analysing the impacts of the reforms and implementing effective benchmark transitions;

• ensuring compliance with BMR requirements, including the implementation of robust contingency plans in the event that the benchmark rates used within the Group should cease to exist;

• deploying legal action plan(s);

• adapting operational processes by preparing Crédit Agricole teams;

• facilitating the launch of activities under the new rates;

• supporting clients in preparing for changes resulting now or in the future from all benchmarks transitions.

Useful links

- IOSCO - Principles for Financial Benchmarks

- FSB - Reforming Major Interest Rate Benchmarks

- ECB : What are benchmark rates, why are they important and why are they being reformed?

- European Commission – Benchmark regulation

- ESMA – Q&A

- FCA – Benchmarks

- Sterling Risk-Free Rates (GBP & SONIA)

- ARRC (USD & SOFR)

- NWG (CHF & SARON)

- Bank of Japan (JPY & TONA)