- #Innovation

- 2019/12/11

- 0

-

14

Villages by CA: start-ups boosting the local and regional economy

Five years after the creation of the first Village by CA, the number of Villages has multiplied in France and internationally. Nearly 800 start-ups incubated and accelerated by Villages by CA are now serving territories, partners and customers. The ecosystem is contributing to the growth objectives of the Ambition 2022 Medium-Term Plan. So how does a Village by CA work? And what challenges are involved for the Group? Find out more in the form of infographics and a video.

Video: “Birth of a Village by CA in Val d’Europe”, the Village by CA Brie Picardie

How does a Village by CA work?

Let’s take the example of the recently created Village by CA Brie Picardie, located 30 km east of Paris.

A strategic location

The start-up accelerator has a surface area of 1,500 m2 and is located 200 m from the Val d’Europe RER suburban line train station, five minutes from the Chessy train station and ten minutes by train from Roissy airport. Val d'Europe is a few minutes from Disneyland Paris, the leading tourist destination in Europe.

Val d’Europe also has a population of 35,000, which is set to double between now and 2030. With its enviable ratio of nearly two jobs per resident working-age adult, Val d’Europe boasts strong economic momentum. It is home to over 5,000 businesses, with 400 new companies joining their ranks every year. The Brie Picardie Regional Bank will soon be relocating its Seine-et-Marne headquarters, currently in Meaux, to Val d’Europe.

In this socio-economic environment, it was natural for the Regional Bank to choose the priority themes of “sustainable cities, construction and homes” and the “tourism economy”.

A further priority focus is “agri-food”, a logical choice for Crédit Agricole and the arable plains of the Brie that skirt the area’s new towns, represented by “local distribution networks”, “top-level produce in cities” and “urban agriculture”.

Partner businesses as ambassadors

The ecosystem of the Village was built through a substantial investment on the part of Crédit Agricole Brie Picardie, which is the Village’s unique shareholder, as well as varying amounts of investment from partner businesses, comprising large companies along with mid-tier enterprises and SMEs.

Ambassador companies are those having made the greatest financial investments but also those who contribute on a daily basis to finding new markets for the start-ups and to testing their expertise in their own territories or business lines. Significant synergies are thus being unlocked day after day between start-ups and partners.

Selecting the start-ups

The Village currently supports eight start-ups. A second call for applications will double that number by the end of the year for a 12- to 24-month support period.

Applicant start-ups fill in an application and are then chosen by a selection committee comprising the Regional Bank and the Village’s ambassador-partners (on the basis of one vote per entity) and, in addition, an expert partner with knowledge supplementing that of the panel.

Start-up commitments

Crédit Agricole does not automatically acquire a stake in the selected start-ups, but there is no obligation for the start-up to be a Crédit Agricole client. However, the start-ups commit to living the Village life, participating in events and dialoguing with each other. This is one of the key strengths of the incubator, which is much more than a co-working space or office rental arrangement. Lastly, by joining a Village by CA, start-ups are able to benefit from access to the network of Villages and meet other start-ups and partners working in the same fields.

-----

Acceleration programme of Village by CA Ille-et-Vilaine

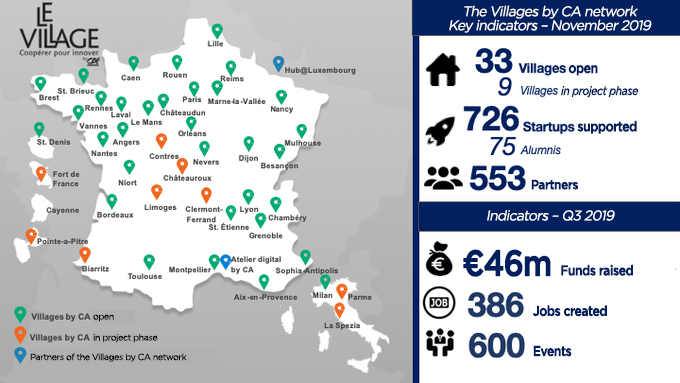

Map of Villages by CA

Websites of the Villages

Village by CA is designed as a venue for sharing and creation, its four main objectives being to:

- foster the emergence of innovative projects and new talents;

- help young companies to implement their solutions and succeed in their business;

- promote, accelerate and disseminate innovation in all its forms;

- contribute to the development of the local and regional economy.

The baseline of Village by CA expresses its ambition in these words: “Coopérer pour innover“ (Cooperate to innovate).

International presence

Crédit Agricole Italy opened its first Village by CA in Milan a year ago. It is now home to 28 start-ups and 16 partners in the fields of gastronomy, fashion, furniture and FinTech. A second Italian Village will be opened in Parma in second-quarter 2020, followed by a third in La Spezia.

Crédit Agricole Ukraine also plans to open a Village by CA in the near future.

In 2018, the five entities of the Group operating in Luxembourg (CAMCA Assurance S.A., Amundi, CACEIS Bank, Crédit Agricole Life Insurance Europe and Indosuez Wealth Management) became a “Partner of the Village by CA network” by creating Hub Luxembourg. The Hub was built to enable start-ups from the Village by CA network to gain an opening to the markets of Luxembourg, Germany and Belgium.

The Village by CA model is also being duplicated by Crédit Agricole partner banks, including Norinchukin in Japan, which benefits from support from the coordination team of the network of Villages by CA of the FNCA.

Lastly, start-ups looking to expand internationally can already rely on an extensive worldwide network, notably through the business sites of Crédit Agricole CIB, including its premises in New York and Tokyo, which already host start-ups from the Village by CA network. Businesses with an international dimension partnering the project also make their premises and services available to start-ups in 25 cities (including London, Moscow, Shanghai, Seoul and Singapore).

In the long term, the Villages will form interconnected ecosystems around the world. Start-ups and large companies will be able to circulate within this ecosystem and form business relationships worldwide.

A network of Villages by CA contributing to the Group’s innovation momentum

The Villages by CA network is part of the strategy of the Group Project on becoming the leading digital bank. To step up innovation momentum, 17 new Villages by CA are planned in France and Italy by 2020, for a total of 46 Villages and 900 accelerated start-ups.

But in addition to digital issues and its business corollaries, and notably to address competition from neo-banks, FinTech and InsurTech, the key objectives are also social, consisting in boosting the local and regional economy and developing employment.

Group and Regional Bank investment vehicles have also been created in order to invest in future “unicorns”, i.e. start-ups having attained a valuation of at least $1 billion.

Boosting our territorial footprint

The Villages are also an opportunity to strengthen the territorial footprint of the Group, and the Regional Banks in particular, and to develop partnerships and foster collaborative efforts between start-ups and local and regional business regardless of their size, be they micro-businesses, SMEs or mid-tier enterprises.

This involves the development of services to boost relationships between the partners.

After an 18- to 24-month support period, the challenge in terms of sustainability is to maintain lasting bonds with start-ups, no longer hosted by but in continued contact with the Village and the Regional Bank.

Developing synergies

The various entities of the Group – Amundi, Crédit Agricole CIB, CA Assurances, CA Immobilier, CAMCA, Nexecur and BforBank – contribute to the emergence and realisation of new ideas in synergy with the Regional Banks. The key issue is to boost these synergies.

This is particularly true regarding growth sources identified by the Group, including the energy transition, agri/agro business, housing, tourism, healthcare and ageing well, and the sea. As organisation by division is vital in this respect.

Cross-cutting “Business Connect” events are organised in which start-ups, partner and client businesses, Regional Banks and Villages by CA share their ideas on a given topic with a view to building shared responses.

Business Connect events boost the visibility of the Villages ecosystem and put pay to the image of financial banks seeking instant profitability.

Lastly, an increasing number of calls for projects are being launched, such as “Start & Pulse” by Sofinco, “100% Compliance” by Crédit Agricole S.A. launched by Village by CA Paris and dedicated to FinTech, RegTech and Compliance Tech start-ups, and the European Plant-Based Protein Awards organised by the Nord de France and Champagne-Bourgogne Villages by CA.

Supporting the Group’s transformation

Working with start-ups boosts creativity and changes working methods, both for the Group’s entities and for partner businesses.

The Villages by CA network provides a support offering for “intrapreneurship” – entrepreneurship within the company – developed by Crédit Agricole S.A. and Fab&O.

Further challenges include the design of career paths for Villages employees (including the mayors), with a view to earning the loyalty of entrepreneurial talents.

Examples of divisions in growth sectors

The Maritime Division

Read the feature article entitled “The Maritime Division at the edge of the world”

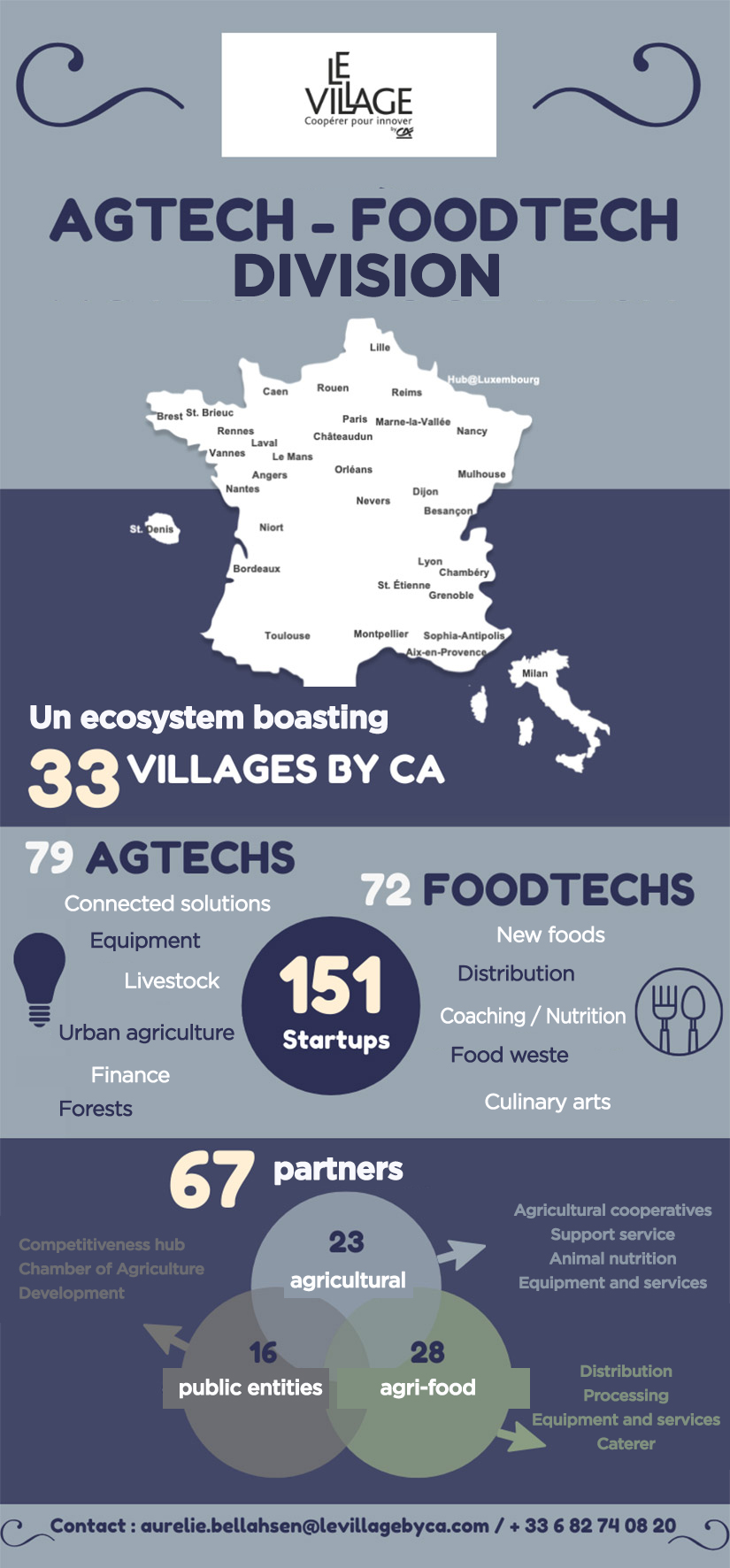

The AgTech-FoodTech Division