-

View article

#Economy

#EconomySouth Korea: a year after the political crisis, markets are buying the promise of stability

2025/12/17

- #Eco-trends

- 2018/07/12

- 0

-

12

Economy: what are the world trends for 2018-2019?

Despite tightening financial conditions in the US and a possible worsening of trade tensions, a cyclical downturn is not imminent. The heady days of simultaneous expansion are, however, now well and truly over.

Growth is still running high in the US and remains vigorous in the Eurozone after a temporary loss of impetus, though it looks set to recede in the emerging economies – the first region to suffer from the killer combination of a rising dollar, rising US interest rates, and growing fears of protectionism.

The US: a rude economic growth

Growth shows no signs of slowing down, driven by household consumption and renewed investment, and also ‘over-stimulated’ by a budget plan that is as substantial as it is inappropriate. As mature as the cycle may be, it has not yet peaked, having been boosted by tax cuts at a time when the economy was already operating at full capacity. The imbalances that generally herald the end of a cycle have yet to worsen. Inflation is rising slowly, though growth is running above potential at 1.8–2%, and the unemployment rate, at 3.8% (having peaked at 10% in October 2009),is lower than its ‘equilibrium’ level; according to the Federal Reserve, an unemployment rate of 4.5% constitutes full employment. However, inflation is beginning to accelerate more rapidly. Obviously, the Federal Reserve is keeping an eye on the situation and will endeavour to promote an orderly slowing down. The US cycle is turning out to be an impressively long one and already spans 107 months of uninterrupted growth, close to the records of 106 and 119 months at the start of the Sixties and Nineties, respectively. If growth continues until June 2019, the current expansionary cycle, which began in June 2009, will be the longest ever recorded.

However, the cycle will soon come up against tightening financial conditions. It will be confronted by a regular tightening of monetary policy, which is likely to take the fed funds rate above its ‘natural’ level (2.9%) in late 2019. Restrictive monetary policy followed by a flat interest-rate curve is a symptom that is supposed to signal a substantial risk of recession. There will also be a mechanical dip in growth when the fiscal stimulus evaporates. The contribution of budget legislation to growth, estimated at 0.8 and 0.6 percentage points in 2018 and 2019, respectively, looks set to be almost non-existent in 2020. In our scenario, having reached our forecast 3% in 2018 and 2.9% in 2019, the growth rate is expected to dip below potential again in 2020.

2020 is the year when the cyclical downturn will come and a US recession cannot be ruled out.

Eurozone: a vigorous growth

In the Eurozone, the economic slowdown in Q118 has raised a number of questions, often met by overly pessimistic, even alarmist, responses.

However, the shock, which can be put down to relatively sluggish exports, does not signal an early end to the growth cycle. There are no crippling constraints on supply, particularly when it comes to the workforce: labour tensions will not derail growth. Growth is subsiding and is coming under threat from external factors, with the tightening of US monetary policy less worrying than the risk of a trade war escalation.

In light of the likely retaliation by the US’s trading partners (though they would have to be moderate, given the losses such retaliation would entail for the countries concerned), it would be overambitious to put a figure on the potential cost of a war that has yet to take shape fully. A trade war would obviously hamper growth. However, even now, before any escalation has occurred, the potential damage to confidence and the ensuing adverse effect on investment decisions is a real cause for concern, in our view.

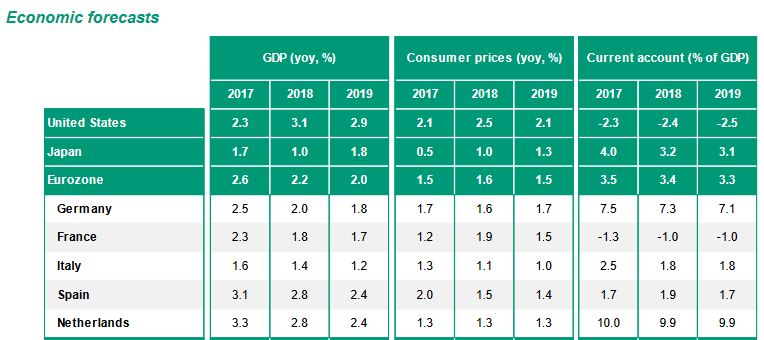

Thus, following growth of 2.6% in 2017, we have slightly lowered our growth forecast in 2018 to 2.2% (2.0% for 2019) to take account of the shock in the first quarter and a riskier environment, though we are not predicting a cyclical downturn in Europe.

Europe has yet to be truly affected by the troubles in the US, which have so far manifested themselves in financial form. However, the potent cocktail of a rising dollar, increasing US interest rates and growing fears of protectionism has raised financial pressure on the emerging economies.

Emerging countries: slightly slower growth, deepening risks

Most emerging countries’ currencies have lost ground, with interest rates coming under upward pressure and credit spreads widening. Though growth has generally held up well in most emerging economies, cushioning them from market pressures, it is generally beginning to drop off. We anticipate a very gradual slowdown across EMs: 4.6% in 2018and 4.5% in 2019.

Oil: Saudi Arabia keeps market in balance

With very high growth rates to continue in 2018 and 2019 in the US, the Eurozone set to lose momentum slightly, and a moderate slowdown in the emerging economies, the picture remains calm for now. However, it is surrounded by substantial risks and is predicated on the assumption that, if Saudi Arabia steps in to guarantee a balance in the oil market, oil prices will remain high but not rise sharply. Our scenario also assumes a slow and orderly increase in interest rates.

Monetary policy: restraint from some central banks

The Fed is determinedly pursuing its tightening of monetary policy in a bid to create a soft landing and give itself greater leeway. The ECB is slowly –very slowly –adopting a less flexible policy. Given the vigorous growth the country is experiencing, the US’s long-term rates are low. But we think powerful counterforces will prevent interest rates rising suddenly. Eurozone interest rates are also low; core interest rates will rise only very slowly but are unlikely to rise violently

Source: Group Economic Research

Click here to access the full article