2021: new benchmarks and the end-game for LIBOR

At the end of the financial crisis, under the impetus of the G20, several international organisations set out guidelines for strengthening the benchmarks that are extensively referenced in financial instruments and contracts. These guidelines also seek to ensure widespread use new reference rate, called Risk-Free Rates (RFR)[1], which will replace benchmarks that cannot be strengthened and which will therefore be discontinued. Among the benchmarks deemed critical due to their systemic importance, the imminent cessation of LIBOR has been confirmed for five currencies - EUR, CHF, JPY, GBP and USD - as has the end of EONIA.

Under the auspices of national authorities around the world, including the ECB for the eurozone, the private sector came together and set up working groups to determine these risk-free rates for each currency. The transition to these new rates includes an adoption period for new contracts and a renegotiation period for legacy contracts referencing rates that will cease to exist. This process is referred to as the “benchmarks reform”.

The replacement of benchmarks will have operational impacts for most market participants, not only the banking sector, and a very large number of contracts will have to be renegotiated.

This report provides an overview of the reforms and the work conducted with all Crédit Agricole Group entities via the Benchmarks project to ensure a smooth transition while protecting our clients’ interests.

1- What exactly is going to change?

1-1 Reminder: what is the benchmark transition?

For information about the background to the reform of critical benchmarks and an explanation of the main concepts, please refer to the report published on the Crédit Agricole Group website on 8 October 2019.

Benchmark transition involves ceasing to use a benchmark and replacing it with one or more alternative benchmarks.

These alternative benchmarks may be overnight RFRs, which are considered more robust by design than the rates they will replace. These rates can also be used to calculate forward-looking or backward-looking term rates.

There are several stages in the benchmark transition:

- The construction and selection of the replacement benchmark

- The sale of products and the signing of new contracts using alternative rates- The transition of legacy contracts referencing benchmarks that are due to cease, either in advance or when these benchmarks are no longer published

1-2 Which transition strategy for legacy contracts referencing benchmarks that are due to cease?

Crédit Agricole Group adheres to the recommendations issued by national working groups and by competent authorities. Unless laws are passed to support the transition ofcertain contracts, difficult or impossible to renegotiate, transition will be managed contractually.

The contractual terms of a number of instruments and contracts will need to be amended. Renegotiations will take place bilaterally or multilaterally depending on the asset class. For example, for interest rate derivatives, the signing of an ISDA protocol should simplify the amendmentof master agreements for all adhering parties, covering most derivatives transactions.

In summary, three transition methods are under consideration, and preparatory work is ongoing in each area:

Proactive transition of legacy contracts

This consists in moving to the alternative rate before the original benchmark is no longer published.

It could take different forms, depending on each situation (signing of a contract amendment or providing notification).

Transition via fallbacks

If a robust fallback has already been included in or added to a contract, the triggering of the fallback will transfer the contract to the new benchmark when the existing benchmark is no longer published or representative.

Transition within a legal framework

The US, UK and European authorities have announced they may provide support for contracts that have not transitioned as of the date when systemically important reference rates such as the LIBOR benchmarks are no longer published or representative. These legal solutions may take different forms depending on the country.

In line with the recommendations of national working groups and authorities, Crédit Agricole Group’s strategy is to prioritise a proactive transition for legacy contracts. If a proactive transition process were to prove difficult or impossible to implement, giving rise to systemic risks for market integrity and investor or consumer protection, the Group may transition some of its contracts through legislative schemes if applicable.

1-3 What does the future hold for the main benchmark rates in use in early 2021?

Decisions to replace benchmark rates vary between markets and currencies. Where transition processes have been announced, the terms and timetables also vary.

On 5 March 2021, the UK Financial Conduct Authority (FCA) confirmed that EUR, CHF, JPY and GBP LIBOR settings (or 1-week and 2-month USD LIBOR settings) will no longer be published immediately after 31 December 2021. Publication of the USD LIBOR will cease immediately after 30 June 2023.

Accordingly, national working groups and authorities are increasingly encouraging all market participants to prepare for the discontinuation of these benchmarks for new contracts (e.g. by no longer using GBP LIBOR for loans, bond issuances, securitisations and linear derivatives from the end of March 2021), to organise a proactive transition for legacy contracts before the cessation of the reference rates , and to prepare for the subsequent triggering of fallback provisions in contracts that were not renegotiated in time to replace the benchmark rate.

For the euro, the EONIA overnight rate will cease to be published on 3 January 2022, when it will be replaced by the €STR. No major difficulties were experienced on the launch of this new rate on 2 October 2019, and since this date, the EONIA has been equal to €STR + 0.085%. Crédit Agricole Group and its peers are working to gradually replace EONIA with the €STR for both new transactions and legacy contracts. (Please refer to the report on this topic published in October 2019). The EURIBOR, the term benchmark rate for the euro, which is used more widely than the EUR LIBOR, is not due to be replaced at this stage, though some further changes to its methodology are planned.

Like the EURIBOR, other important benchmarks may be maintained at least in the short term, such as the Swedish benchmark, STIBOR, and the Polish benchmark, WIBOR. Elsewhere, like for the LIBOR, the replacement of benchmarks has already begun, for example for the CDOR in Canada, and the HIBOR in Hong Kong.

2- FOCUS ON LIBOR TRANSITIONS

2-1 What is the transition timetable?

The terms of the transition, such as interest rate conventions or the credit adjustment spread[2] to be applied when transitioning legacy LIBOR contracts to alternative benchmarks, have been established on an iterative basis. There are prerequisites before release of detailed transition plans. In preparation for the cessation of benchmarks, authorities and working groups strongly recommend that parties no longer use these benchmarks and begin the transition of contracts referencing them as soon as possible before the dates on which they will no longer be published or will become non representative.

The transitions will take place in three stages:

1) Adoption of the risk-free rate and cessation of LIBOR usage for new transactions

The transition of new transactions to risk-free rates is relatively well advanced for derivatives, but is progressing much more slowly for cash products, and varies by currency.

Authorities and industry working groups have already set some key milestones.

Provisional timetable

| Warning: the timetable provided below is a non-exhaustive summary, applicable as of March 2021.For a more exhaustive up-to-date view of the milestones, please refer directly to communications by the competent authorities and national industry working groups.Crédit Agricole Group takes into account these milestones – which can be incentive or binding depending on the currency or asset class - in the definition of its transition plans. |

|---|

2) Proactive transition of legacy contracts before the cessation of the benchmark or by triggering fallbacks.

The authorities unanimously recommend transitioning as many contracts as possible before the LIBOR settings are no longer published.

For contracts that cannot be renegotiated proactively but which include fallbacks, depending on the asset class, the fallbacks will be triggered on the date publication ends or the date on which the rate is no longer representative (i.e. the end of 2021, with the exception of the most widely used USD LIBOR tenors, which will be discontinued in June 2023) to transfer the contracts to the appropriate alternative rate.

3) Legacy transition through law

Lastly, although the scope has to confirmed, a legal framework may be adopted to enable contracts to continue referencing LIBOR using a “synthetic LIBOR” for a limited period of time, or to enable a transition with an alternative rate designated by the authorities for contracts that were not transitioned using one of the methods described above (early renegotiation or triggering of fallback provision when the benchmark ceases to be published).

2-2 How will it work?

In most cases, LIBOR benchmarks are due to be replaced by compounded RFRs (fixed in arrears[3]) or by term rates fixed upfront[4] using RFR derivatives markets, plus a credit adjustment spread.

1) What replacement rates are being used for LIBOR?

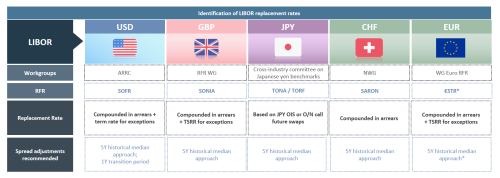

Working groups in all the major financial centres have determined the risk-free rates (RFR), and are using these rates to construct the LIBOR replacements.

2) What term rate structures will be used?

For the transition of legacy transactions, the benchmarks they reference will be replaced by forward-looking or backward-looking rates based on the RFR plus a spread adjustment intended to minimise the economic impact of the transition.

There are two major categories of term structures to replace LIBOR benchmarks:

- Backward-looking rates:

• These rates are calculated after a given observation period and are not known at the start of the interest period for most interest rate agreements, except for “last reset” or “last recent”conventions.

.

- Forward-looking rates:

• These rates are set in advance for a given maturity.

• They are based on market expectations of overnight rates as observed on derivatives markets.

Forward-looking rates enable both the borrower and the lender to know in advance the amount of interest they will pay/receive.

However, backward-looking rates are deemed to better represent market reality because they are calculated using overnight rates actually observed rather than expectations.

As such, in many cases, national working groups on risk-free rates and the authorities recommend using backward-looking compounded rates, in particular using a compounded interest methodology, to replace the LIBOR benchmarks for different maturities. However, forward-looking rates may still be applied for some activities that have specific constraints.

3) What credit adjustment spread applies for the transition of legacy LIBOR contracts/transactions?

The credit adjustment spread applied to legacy contracts[5] transitioning from LIBOR to the alternative benchmark based on the risk-free rate aims to maintain the economic equivalence before and after the change of benchmark.

From an early stage, ISDA recommended using an historical median over a five-year period for fallbacks in derivatives contracts (to be applied on the date the LIBOR ceases or is no longer representative). This methodology is referred to as the “ISDAspread”. Some industry working groups also recommend this solution for fallbacks for products other than derivatives.

Following the announcement by the FCA on 5 March that the LIBOR will be discontinued on 31 December 2021, Bloomberg published the values that these ISDA spreads will have on this date, by LIBOR currency and tenor. For active transitions ahead of LIBOR discontinuation dates, parties can consider different options such as using market spreads.

In any case, the objective is to maintain economics of the contract remain equivalent and avoid value transfer.

3- Focus on EURIBOR

The EURIBOR administrator (EMMI) has used its prerogatives to reinforce EURIBOR governance and the calculation methodology to comply with FSB/IOSCO recommendations and the requirements of the Benchmarks Regulation (BMR).

EURIBOR is authorised under the BMR and has been included in the ESMA register since 2 July 2019. This benchmark can therefore continue to be used with no time limit unless it ceases to be published and is replaced by an alternative or is no longer representative. Unlike the LIBOR, no formal announcement has been made yet by the authorities regarding the discontinuation and replacement of EURIBOR by an alternative such as the €STR. However, like any benchmark, in time, EURIBOR could transition to an alternative rate.

4- Do you have exposures to benchmarks that are to be discontinued? What impacts should you expect?

The discontinuation and replacement of benchmarks, the adoption of alternative rates in new contacts, and the transition of legacy contracts have different impacts, including:

- Operational impacts : Updating of processing systems and procedures

- Legal impacts: Implementation of fallbacks to enable the transition, direct contract renegotiations or amendments to reference the alternative before the current benchmark ceases or is no longer representative

- Financial impacts : Hedging; application of the spread adjustment between the former and the new benchmark for the transition of legacy contracts

- Accounting impacts

- Tax impacts

National working groups are striving to achieve the most seamless, harmonised transition possible to minimise the impact on clients. Crédit Agricole Group adheres to these principles.

Crédit Agricole Group will provide all the support you need throughout the transition phase.

All market participants must also prepare. We recommend that clients exposed to benchmarks that are due to cease should actively prepare, in particular regarding some or all of the following:

- Integrating the new benchmarks in their systems, including preparing for their use and understanding the potential impacts

- Managing the new interest rate calculation conventions

- Measuring and anticipating a possible fragmentation between asset classes and currencies (if alternative benchmarks with different methodologies, conventions, or implementation timetables are used)

- Preparing to be asked to amend contracts or informed about new terms

To this end, as well as providing further insight, your Crédit Agricole coverage is available to answer your questions and will give you details on how the transition to an alternative benchmark will be organised (whether this involves direct renegotiation of the interest rates or the insertion of fallback provisions to ensure a seamless transition when benchmarks are discontinued).

[1] Risk-Free Rate: the interest rate that can be obtained by investing in a financial instrument considered to have no risk of default. This rate is generally based on unsecured overnight lending rates or secured overnight repurchase transactions (repos). The RFR is calculated on the basis of actual transactions, making it more accurate than benchmarks calculated using fixing mechanisms.

[2] The credit adjustment spread is the difference between the LIBOR and the RFR.

[3] Also known as backward-looking rates.

[4] Also known as forward-looking rates.

[5] Credit adjustment spread does not apply to new contracts/transactions.