Along with global warming, the loss of biodiversity is the other major challenge facing humanity. 75% of terrestrial environments and 66% of marine ecosystems are now severely degraded, and yet, half of the world's GDP, is moderately or highly dependent on nature and its ecosystem services, according to the World Economic Forum.

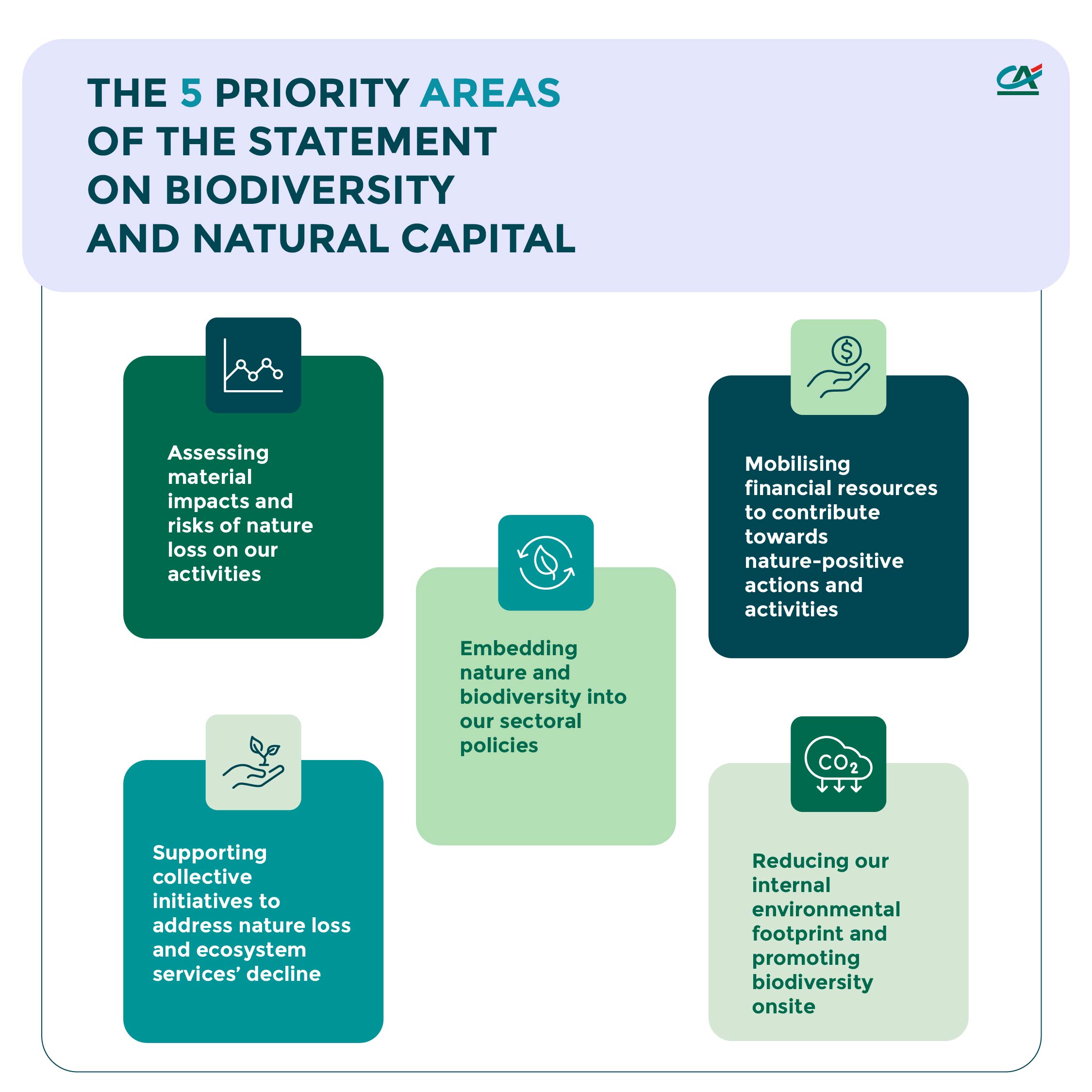

In 2023, Crédit Agricole S.A. published a “Declaration on Biodiversity and Natural Capital”, defining its 5 priorities:

Assessment of nature dependencies, impacts, risks and opportunities (DIRO)

Through nature pilots, Crédit Agricole Group continues to test emerging tools and methodologies to measure the potential impacts and dependencies of its financing and investment activities.

Integration of ESG criteria linked to biodiversity

Crédit Agricole Group's various business lines have implemented responsible financing and investment policies to incorporate ESG criteria relating to nature and biodiversity.

1. Financing

- Inclusion of biodiversity-related criteria in CSR Sector Policies referring to International Finance Corporation Performance Standard 6 and the Equator Principles (e.g. Deforestation Policy).

- Establishment of exclusion criteria for the financing of projects in protected areas or sites (UNESCO World Heritage, Ramsar sites, Alliance for Zero Extinction (AZE), etc.).

- In June 2025, Crédit Agricole committed not to finance deepsea mining projects until it has been demonstrated that this extractive activity can be undertaken without significant impacts on marine ecosystems, in line with the positions of the French government and the European Union. (Find out more)

2. Investment

- Integration of biodiversity issues into internal analysis and investment processes and adoption of a specific "Biodiversity and Ecosystem Services" policy within Amundi's general responsible investment policy (Find out more)

- Development of an investment framework to measure and monitor the impact of portfolios on biodiversity. This proprietary approach was introduced at the end of 2023 with the ambition of developing new thematic investment strategies, specifically focused on biodiversity issues.

Contributing to national and international nature initiatives

The Group contributes to national and international initiatives to better understand the impacts and risks of the degradation of nature and biodiversity, as well as opportunities to contribute to its preservation, conservation and restoration.

Market initiatives and coalitions:

- UNEP-FI: Co-chair of the PRB Nature Target Setting Working Group (2023);

- Taskforce on Nature-Related Financial Disclosures (TNFD): Member of the TNFD Forum and TNFD Early Adopters for FY 2025;

- Amundi: Finance for Biodiversity Pledge in 2021, CDC Biodiversité B4B+ Club, (Business for Positive Biodiversity Club) and Nature Action 100 in 2023;

- CA Immobilier & Amundi Immobilier: Biodiversity Impulsion Group (BIG)

Sites committed to biodiversity

Crédit Agricole has set up nature protection initiatives involving its organisation and employees. Several of the Group's sites have been accredited thanks to their commitment:

- the Montrouge and Saint-Quentin-en-Yvelines sites have been awarded the “LPO Refuges” label for preserving and welcoming local biodiversity;

- the Evergreen campus has been awarded the “BiodiverCity Life” label for its development of the ecological value of a site in operation.