-

View article

#Economy

#EconomyChina: confidence, price war and credibility are the watchwords in this early part of the year

2024/03/26

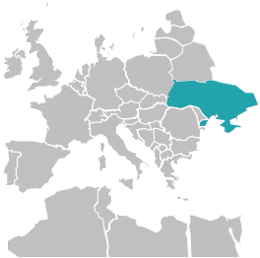

Crédit Agricole in Ukraine

Crédit Agricole arrived in Ukraine in 1993 as a solid but small bank that only served corporate customers, mainly international, and a few large, local, corporate customers. Over these 25 years, the bank grew into a large (one of the TOP 10 in assets) universal bank serving all market segments – from private individuals to large international corporations.

-

Crédit Agricole Ukraine (CAU)

Joined the Group in 2006 (Index Bank).

Following a profound restructuring, has operated under Crédit Agricole brand since 2011 and merger with CACIB Ukraine.

A universal retail bank with a strong specialization in MNCs and agri-food, a market in which CAU has a strong reputation and expertise.

Has been maintaining a high level of profitability also during the restructuring phase of the banking industry following the Ukrainian crisis of 2014.

Leadership in Agro-agri and development of the corporate segment. Strong financial performance in 2019 with solid underlying fundamentals.

-

Key figures

Ukraine: 43.79 million in habitants

+ of 400 000 customers

141 branches

2,150 employees

Total assets: 1.8 Bn€Highlights - Prizes and Awards

- Deal with the European Bank for Reconstruction and Development, EBRD to support micro, small and medium sized companies

- First bank of the country to launch the Mobile SIM service

- Launch of new CA+ app features

Source: IBD/FIN - Data at 12/31/2022

-

Strategic approach

MTP 2022 Strategic ambition: ensure a high profitability through a balanced sectorial growth

- Stengthen leadership position on MNCs and Agri / Agro through the development of expertise. Strengthen cooperation with Group entities in France and abroad (Germany, Poland); Implement a specialization strategy on key sectors and expertises. Enlarge products offer (leasing);

- Balance the model by tending towards 50% of Proximity Banking revenues: omnichannel distribution strategy, deployment of the Group's marketing and distribution tools, development of advanced mobile solutions, optimization of funding in local currency;

- Strengthen customer satisfaction in support of the move upmarket with a focus on the mass/affluent segments.

-

Key economic indicators

Data

France

Ukraine

Currency

EUR

UAH

Population (in millions)

67.1

41.5

Population growth rate

0.3

-0.6

Nominal GDP (in USD billions)

2,599

152

Real GDP growth, annual (%)

-8.2

-4.2

Nominal GDP growth (%)

-6.2

2.9

GDP per inhabitant, current USD

39,907

3,653

Inflation rate

0.5

2.7

Unemployment (%)

8.0

9.0

National saving rate

21.4

10.9

Household savings rate

21.3

nd

Budget deficit/GDP (%)

-9.2

-6.2

source : Insee FMI, ECO (Data at end 2020)