Today’s environment is marked by inflation coupled with a housing crisis. In response, the French government has strengthened the interest-free loan scheme to “address the collapse in mortgage lending”. The maximum amount of the interest-free loan has been increased from €80,000 to €100,000 and income caps have been raised so that more households can benefit. The Crédit Agricole Regional Banks have joined in the effort by doubling the amount of the interest-free loan taken out by their customers up to a maximum of €20,000, free of administrative fees. For its part, LCL also offers an interest-free loan of the same amount intended for young first-time buyers. This is not the first time that the Group has taken action to promote housing for the French population, as it has been present in this sector for 95 years.

The story began back in 1928

The Loucheur Act introduced on 13 July 1928 was aimed at opening up new loan opportunities to encourage French people to buy a home. The objective was to build 200,000 homes or low-cost housing units. One of the most interesting aspects of the initiative concerned rural homes, part of a substantial effort to improve housing conditions in the countryside. The Crédit Agricole Regional Banks contributed to the initiative by being classified as real estate credit companies in their area of expertise, i.e. rural areas with fewer than 2,000 inhabitants.

They were qualified to distribute loans to agricultural workers and low-net-worth owners and operators for construction, the acquisition of existing buildings for reconstruction, and the development, repair and improved sanitation of homes. This possibility also extended to the homes with workshops of rural craftsmen. Always quick to adopt measures to curb the desertification of rural areas, the Regional Banks took full advantage of this new tool, which also enabled them to extend their field of competence. As underscored by the Var Regional Bank in its 1929 annual report, “We are convinced that the new legislation will enhance and improve the sanitation of rural housing, provide farmers, and workers in particular, with more comfortable and attractive housing, and encourage people not to leave their village or farm for the city.”

Promoting housing for young people and pensioners

In 1939, a more specific measure aimed at young farmers’ households was introduced, with a decree-law implementing a ten-year 4.25% loan to enable this population to set up homes (purchase of equipment and housing development). However, the war suspended the application of this measure. After further negotiations, the Law of 24 May 1946 was introduced, extending the definition of “young farmers” to the 21-35 age group and thus increasing the number of potential beneficiaries. A few years later, in 1953, the National Bank began issuing periodic loans, used to finance start-up loans and home ownership loans for farmers. Loan outstandings for farmers’ housing rose a full 7.3% to 14.5% between 1954 and 1955, reflecting real demand for improvements in the housing conditions of farmers.

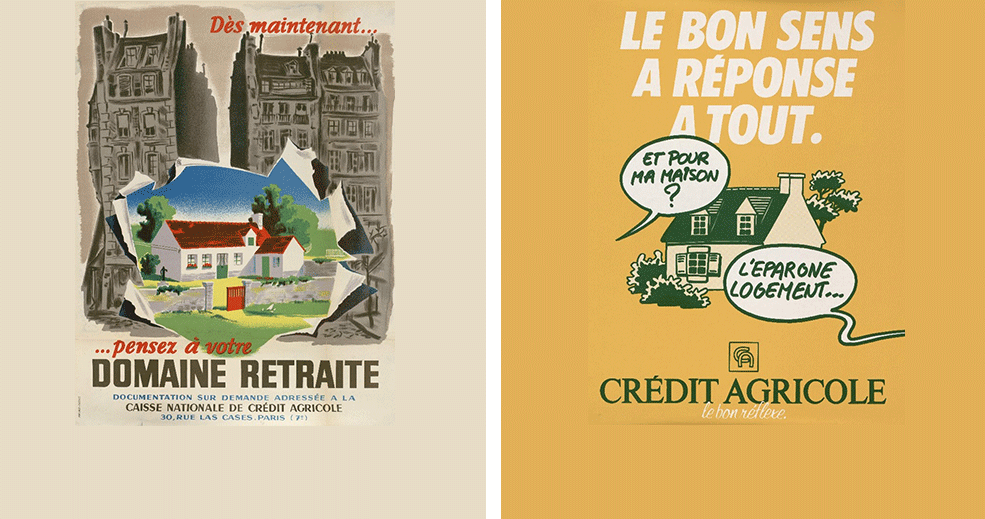

In parallel, the Regional Banks and the Caisse Nationale were authorised to distribute the Domaine Retraite passbook in 1938. The savings account was “mainly intended for elderly workers and aims to combat the rural exodus by allowing urban residents to build up retirement capital in minimal annual payments that they can enjoy at the end of their career”. The themes of housing and rural exodus continued to be closely linked. In 1939, the La Creuse Regional Bank welcomed the new measure as follows: “There is no doubt that in a department like ours, where there is unfortunately a significant rural exodus, […] the Domaine Retraite [is] likely to attract the attention of all the people having emigrated from Le Creuse and seeking to return to their homeland in their old age”. Importantly, the Domaine Retraite passbook was open to people not necessarily working in farming but seeking to return to the countryside on retirement. The new product thus further extended the competencies of Crédit Agricole.

The turning point of 1959

A true housing breakthrough was made in 1959 as Crédit Agricole was now able to grant home loans to the entire rural population and not just to farmers. Crédit Agricole’s reach was thus extended to a potential 43% of the French population. The aim was to contribute to the fight against the crisis in affordable housing and to the boom in housing investment. It was also a time when rural people were seeking to improve their living standards and catch up with those of city dwellers. In this respect, France was now divided in two, with Crédit Foncier de France responsible for financing housing in cities and Crédit Agricole responsible for rural areas.

Crédit Agricole’s share of the housing loan market grew rapidly, from 1.5% in 1959 to 11% in 1969 and 13% in 1972. This growth was boosted when Crédit Agricole was authorised to distribute home savings plans in 1967 and home loans in 1972. Meanwhile, the share of farmers in these loans automatically decreased, from 100% in 1959 to 33% in 1969 and 22% in 1972. Aware of this shift in its business, Crédit Agricole strongly expressed its ambitions in terms of housing financing. Speaking at the 1977 General Meeting, André Costabel, Secretary General of the FNCA, said: “I would like to reaffirm Crédit Agricole Mutuel’s commitment to playing an important role in home financing; to create pleasant, comfortable homes across France that incorporate the latest technology and respect the beauty of our country.”

Towards “Crédit Agricole and housing”

Crédit Agricole’s market share continued to increase steadily in the 1980s (one-third in 1983). This performance was bolstered by the authorisation granted in 1981 to work outside rural areas and thus prospect urban customers. Housing financing outstandings gradually surpassed those of agriculture. The fall of Crédit Foncier de France in 1993 further reinforced Crédit Agricole’s position in this market and its leadership stance was confirmed by Housing Minister Pierre-André Périssol, who, speaking at the FNCA conference in 1995, praised Crédit Agricole in its roles both in farming and housing.

In the 1990s, Crédit Agricole worked on the distribution of new mortgages for low-income households (PAS) and sold one out of three interest-free loans. In just a few years, it became a specialist in social housing. Business activity was hampered by the 1993 crisis in the real estate sector but recovered starting in 1996. Unlike other institutions, Crédit Agricole was not impacted excessively by this crisis.

●●●

From this period onwards, Crédit Agricole retained its leading position in housing. As part of the 2010 Group project, housing was even identified as one of the Group’s areas of excellence. At the same time, it structured its real estate business with the launch of the Square Habitat network in 2004 and the creation of Crédit Agricole Immobilier in 2010. Since the beginning of its involvement in housing, Crédit Agricole has always had two complementary objectives: to promote access to housing for customers and thus contribute to the vitality of the regions.