Financial Literacy Week provides every year thousands of people with the opportunity to learn about managing their own resources. Since its inception, Crédit Agricole has enabled its users to develop their financial knowledge.

1960s advertising brochure

Crédit Agricole, a financial education tool in itself

Crédit Agricole developed financial education operations for its cooperative shareholders at an early stage. At the end of the 19th and early 20th centuries, the aim was to spread mutualist theory and practice. This included the role assigned to the departmental agricultural teachers and the first inspectors of the agricultural credit unions.

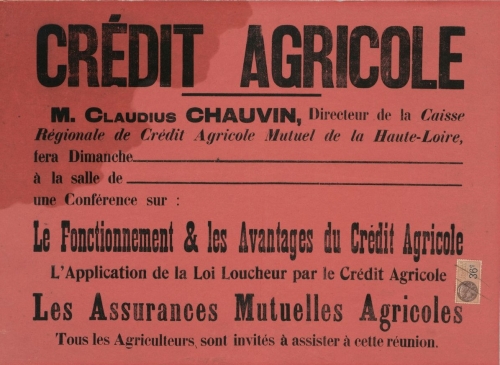

Poster from the 1930s of the Haute-Loire Regional Bank for an information meeting

on Crédit Agricole and insurance.

Crédit Agricole was also the main promoter of the use of checks in rural areas from the 1930s onwards. Because of its monopoly position in the distribution of start-up loans to young farmers, it has helped this segment of the population learn about finance. After the war, this objective was achieved by broadcasting films at information meetings in villages.

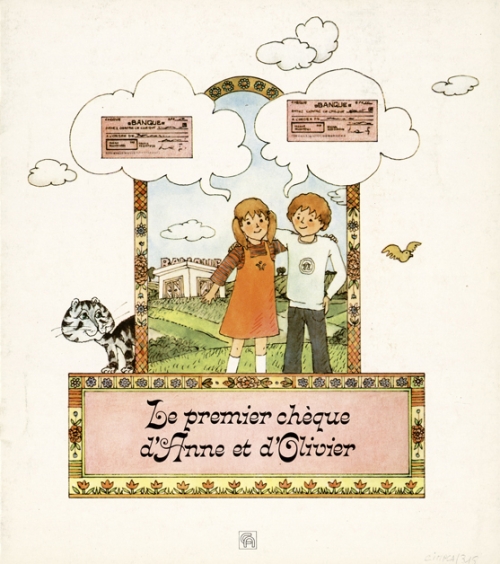

In the 1950s and 1960s, Crédit Agricole targeted children in its communications by distributing, for example, notebook covers in schools. Later, we find the trace of some educational operations for children in the 1970s and 1980s, with the distribution of CAMI accounts for children by the Ile-de-France Regional Bank. The opening of these accounts is accompanied by documentation specially designed for the learning of the management of a bank account.

Around 1978, the Caisse Nationale issued “young checks” for children who went to summer camps. The instructions state that the use of these checks is under the authority of the colony director.

Bande dessinée pédagogique du Crédit Agricole (1977)

Continuous action

Later, in 2013, Crédit Agricole is stepping up its efforts in prevention and budget education. A dozen regional banks are working in partnership with schools, associations or social organisations to raise awareness of money among young people and households in difficulty and thus prevent situations of over-indebtedness.

Training provides them with the knowledge to manage their budget and feel more comfortable with financial matters, including tools and advice. Internationally, Crédit Agricole Bank Polska and its Serbian subsidiary are also developing financial education programmes. In 2015, 100 budget education workshops were attended by 1,000 people.

Educational comic strip from the Toulouse Regional Bank 31 (2010)

Lastly, in 2016, 19 regional banks offered a budget and banking education programme to prevent high debt. 3,100 people, 60% of them young people, attended the 310 workshops co-organised with schools and various associations. These actions are also being rolled out internationally: in 2017, 1,264 students attended workshops in Italy; 220 young people in Germany.

There are many more examples, but what should be remembered is that the Crédit Agricole Group has been a major player in financial education since its inception, sometimes unknowingly. His work continues, particularly with his participation in the “Banker in my Class” operation.