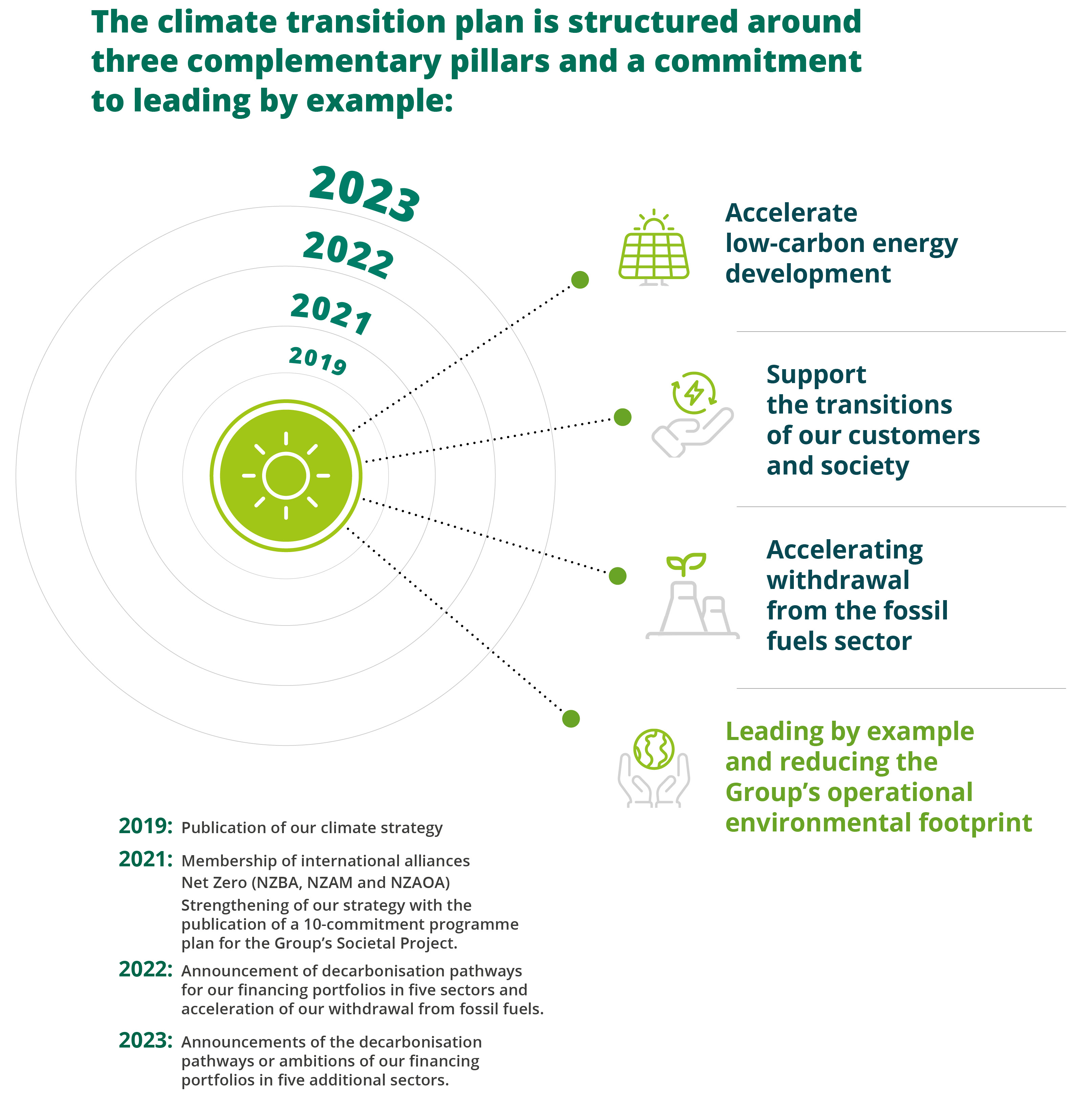

Published in 2019, strengthened in 2021 by joining the Glasgow Financial Alliance for Net Zero, and further accelerated by our sector commitments in 2022 & 2023, the Group’s climate strategy or transition plan is an ambitious plan to help reach carbon neutrality by 2050.

Contribution to the SDGs:

Crédit Agricole Group's climate transition plan is based around three principles and a desire to lead by example:

Accelerating low-carbon energy development

Crédit Agricole Group is a leader in private finance for renewable energy in France, with more than 25 years' experience in the field. It is investing heavily and concentrating its financing on the development of renewable energy. By creating Crédit Agricole Transitions & Energies in late 2022, it has structured a new business line, that of a regional energy services provider, and affirmed its tangible support for the sector.

Supporting energy-efficient building renovation

- The website “J'écorénove mon logement” offers a range of services designed to make home energy renovation and energy sobriety accessible to everyone. It recorded over 650,000 unique visitors in 2024.

- Finance solutions

Developing low-carbon mobility

Credit Agricole Personal finance & Mobility makes it easier for customers to finance their sustainable projects:

- Financing low-carbon vehicles, with the aim that 1 in 2 new vehicles financed will be hybrid or electric and 1 in 3 be fully electric by 2025. These commitments by Crédit Agricole Personal Finance and Mobility will enable Crédit Agricole Group to reduce CO2 emissions from car financing activities by 50% by 2030 compared with 2020.

Supporting the transitions of our customers and society

Innovative products and services in support of the energy transition

A policy to support the agricultural and agri-food transitions

Decarbonising our financing portfolios

By 2050, the Group is committed to aligning the greenhouse gas emissions generated by its activities with the trajectory of carbon neutrality. Crédit Agricole has also set intermediate targets for 2030 and reports annually on its progress. For financia lbusiness lines, the decarbonisation strategy is based on a selection of the ten sectors with the highest greenhouse gas emissions, representing around 75% of global emissions and 60% of the Group's assets under management.

Our sector commitments for 2030

Learn more about the ten activity sectors and our 2030 objectives

Learn about the investment commitments of Amundi and Crédit Agricole Assurances.

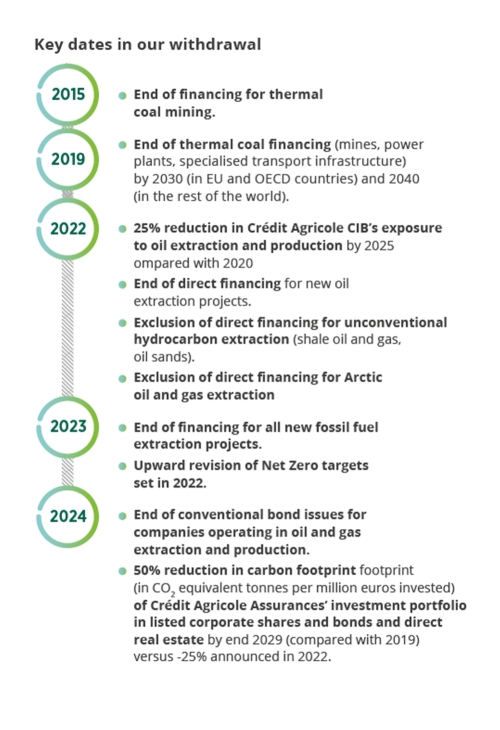

Accelerating the withdrawing from the fossil fuel sector

Since 2015, Crédit Agricole has been continuing its structural commitments to accelerate its withdrawal from the fossil fuel sector. By 2030, we will be going twice as fast as the International Energy Agency's recommendations in reducing our financing of fossil fuels.

-

Reducing our operational footprint

As a financial institution, the majority of our emissions are linked to our financing and investment activities. However, as part of our exemplary approach, we attach great importance to reducing emissions related to the environmental footprint associated with our own operations as a company.

These reductions involve a policy of energy sobriety and management of business travel and building operations, as well as a policy aimed at optimising IT services and digital responsibility and decarbonising purchasing. The strategy to reduce greenhouse gas emissions goes hand in hand with actions to improve the preservation of natural resources and biodiversity at our sites.

Four objectives for 2030

As part of its strategy to contribute to carbon neutrality by 2050, the Group has set itself four medium-term objectives for 2030:

- 50% reduction in greenhouse gas emissions linked to Scopes 1 and 2 by 2030 (vs 2019) ;

- 50% reduction in greenhouse gas emissions linked to business travel by 2030 (vs 2019) ;

- 100% renewable electricity in France and abroad by 2030 ;

- Crédit Agricole S.A. is committed to ensuring that its suppliers accounting for 40% of its expenditure related to the purchase of goods and services and fixed assets have science-based reduction targets by 2027.

Reducing the environmental footprint of digital technology

Against a backdrop of digital transformation in businesses and growth in usage, we need to be aware of the environmental impact of digital technology and take action to make it more restrained and considered, while using it as a lever for the ecological transition. This also means taking ethical and accessibility issues into account.

With the Responsible Digital Programme, linked to its Societal Project, Crédit Agricole's aim is to reconcile digital technology with sustainable development objectives and to promote technology that is more environmentally aware, inclusive and ethical.

Crédit Agricole Group Infrastructure Platform, the entity responsible for the Crédit Agricole Group's IT production, has been awarded a 3-year renewable label by the independent agency LUCIE.

.

The label at level 2 (the most demanding level) certifies to all our stakeholders that CA-GIP is committed to a concrete and demanding Responsible Digital approach.Here are some examples of sustainable initiatives taken within the Group as part of its CSR strategy:

- Digital eco-actions booklet: this booklet was made available to all Group employees in 2023. EcoCode Challenge: Crédit Agricole sponsors and organises the ecoCode challenge ♻️, a collective initiative aimed at reducing the environmental footprint of digital technology in collaboration with the ecoCode collective ;

- The Accessibility approach at BforBank: to make its digital products accessible to as many people as possible, this multi-stage approach aims to apply the principles of accessible design and development within the Marketing, Products and Technology Departments ;

- Serenipay: this payment solution from Crédit Agricole Payment Services is designed for the visually impaired and seniors, with a Bluetooth card and an application that describes the payment steps ;

- DANA: this eco-designed and accessible internal page aims to raise awareness among Crédit Agricole Payment Services employees of good accessibility and eco-design practices ;

- Olinn: in 2021, Crédit Agricole acquired Olinn, an IT equipment reuse and recycling company. Olinn is also a company adapted for people with disabilities, with 65% of its employees being disabled.

A policy recognised by stakeholders

- The NGO Transport & Environment praised Crédit Agricole S.A.’s travel policy, awarding it the highest rating of A ;

- Several Group entities have been awarded the “Responsible Digital Level 2” label ;

- Crédit Agricole S.A.’s two main sites have been awarded biodiversity preservation labels: the Montrouge campus (the Group’s headquarters) has been awarded the LPO and Biodivercity Life labels. The Saint Quentin en Yvelines campus has been awarded the LPO and Ecojardin labels.