The ceremonies commemorating the armistice of 11 November 1918 are an opportunity to study Crédit Agricole’s history during the war. For four years, he was confronted with a new situation for him which slowed down his development but also allowed him to show his usefulness.

Disrupted operation

In 1914, Crédit Agricoles was still a young organisation: the creation of the first local bank in Salins-les-Bains only dates back to 1885, the law allowing the generalisation of this model of farm credit companies dates back to 1894 and the first regional banks, created in 1899, are only about fifteen years old. As for the central body, it does not yet really exist, since it was not until 1920 that the National Office of Crédit Agricole (direct ancestor of Crédit Agricole S.A.) was born. There is, however, a commission for the distribution of State advances under the Ministry of Agriculture, which sets the main guidelines.

The war is disrupting Crédit Agricole’s organisation. The mobilisation of men of fighting age leaves only women and older or reformed men on farms. Investment, and hence demand for credit, is falling. This was compounded by the unavailability of many directors, employees and volunteers, and the movement of some caisses, such as Reims, which had to flee the advance of German troops. Others, due to the absence of staff, are having trouble functioning: the Finistère Regional Bank can no longer keep its accounts up to date and the Côte-du-Nord Regional Bank is suspending its activities for a period. Women then appeared to take part in the management of certain regional and local banks, such as Ms Trouvé in Seine-et-Oise.

However, from 1916, Crédit Agricole got back on track. In particular, the General Inspection of Credit and Agricultural Associations was set up. The French government also relies on Crédit Agricole in various areas, particularly for its productivist policy aimed at supporting the war effort: Crédit Agricole will then intervene in various financing measures.

Serving the country

First, in 1917, in an “appeal to all the French people in our countryside”, various personalities, including the four ministers of agriculture who had succeeded each other in the Great War, encouraged the French to produce more to support the war effort. Crédit Agricole, in addition to its traditional role as a lender to agriculture, then acted as a financier of various measures. For the first time, it is lending to municipalities and departments, as well as cooperatives, for work to rehabilitate land abandoned due to the fighting. However, due to the unavailability of labour force, this measure will be more effective once peace is restored.

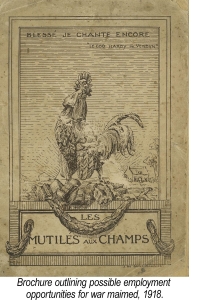

A larger measure was taken in 1918, before the end of the war. This is the possibility for Crédit Agricole to grant low-interest loans to disabled war victims so that they can acquire, develop or reconstitute a small holding. On this occasion, Crédit Agricole is partnering with the Labour Department of the Ministry of Agriculture to produce a brochure that shows disabled people how to return to work according to their disability. This action by Crédit Agricole is fully in line with its objective of combating rural exodus and boosting French agriculture.

Following the end of the war, Crédit Agricole demonstrated its usefulness, even in times of crisis and for vulnerable populations. Its means of action will then be constantly increased with the aim of always meeting the different needs of its customers and cooperative shareholders. In 1920, it was able to grant loans to rural craftsmen and, from 1923, it was able to finance electrification work in rural municipalities. Its policy, through these measures, is then to combat the desertification of the countryside.