Hong Kong, one of Crédit Agricole's oldest foreign business locations

The beginning of the Group's presence in Hong Kong dates back to a Banque de l’Indochine branch. Eighty years later, Crédit Lyonnais also set up there, before Crédit Agricole established a foothold from the 1980s.

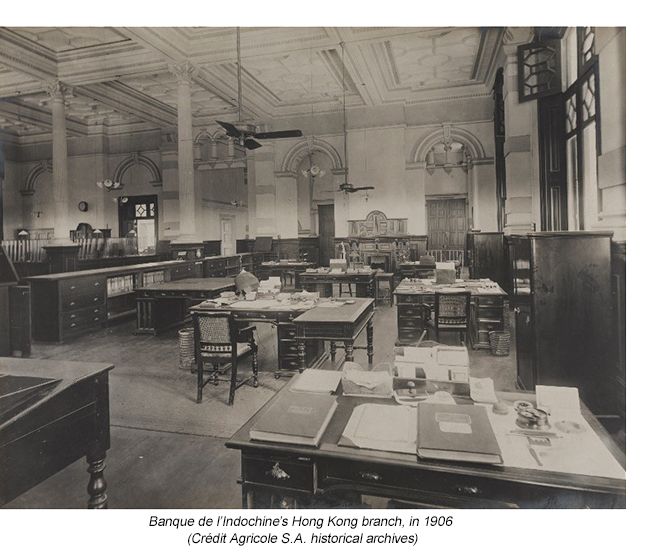

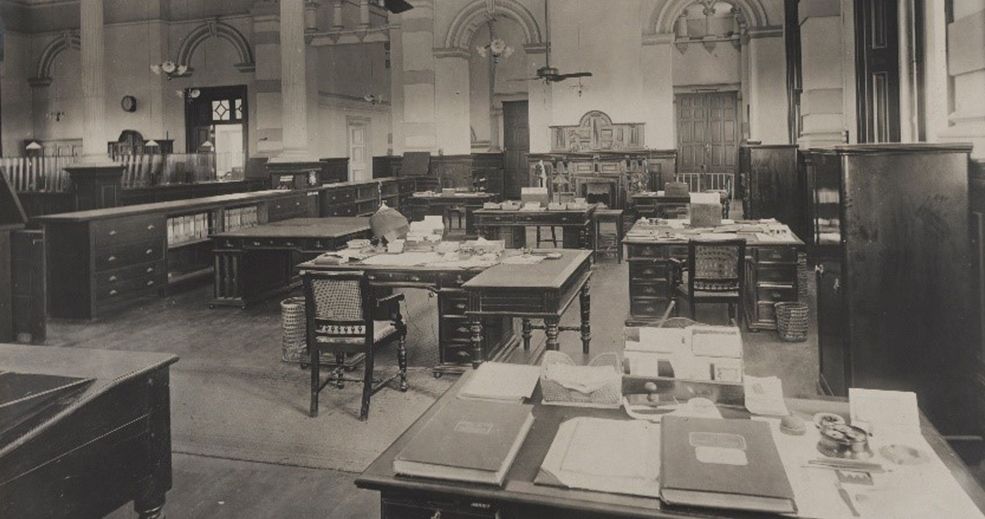

One hundred and thirty years ago, by a decree dated 30 March 1894, France’s Ministry of Colonies gave Banque de l’Indochine permission to open a branch in Hong Kong, which was then a British territory. It quickly became a significant source of growth for the bank. Following the loss of its branches in Indochina and then China after World War II, Hong Kong allowed Banque de l’Indochine to keep some influence in Asia. By 1971, the branch office headed a network of four neighbourhood offices. During the 1970s, Banque de l’Indochine and then Indosuez created finance companies, including the holding company Indosuez Asia Holding in 1976. From the 1980s, this company coordinated Indosuez’s banking and financial activities across all of Asia from Hong Kong. The acquisition of WI Carr during this same period additionally enabled Indosuez to work in the asset management business.

At the same time, from 1974, Crédit Lyonnais was also setting up in the British colony. It began by creating two financial subsidiaries before opening a full-service agency in 1978. From 1987 to 1989, the bank built a local securities management subsidiary which was to become highly regarded, namely Crédit Lyonnais Securities Asia (CLSA). From 1990, Crédit Lyonnais was also expanding locally in asset management.

It was actually with asset management that Crédit Agricole first set up in Hong Kong, forming a local subsidiary in 1982. The Caisse Nationale branch office did not open until 1985. Crédit Agricole’s situation saw little change until the Banque Indosuez purchase in 1996. Renamed Crédit Agricole Indosuez, the new corporate and investment bank was operating in Hong Kong through three units in the forms of Indosuez Asia Shipfinance Services Ltd., Indosuez WI Carr Securities Ltd. and Suez Asia Holding (Hong Kong) Ltd.

In 2003, Crédit Agricole acquired Crédit Lyonnais, the financing and investment banking arm of which was integrated into Crédit Agricole Indosuez. The new combined unit was named Calyon. By 2009, Calyon was operating in Hong Kong through one branch office and three subsidiaries: CAAM Hong Kong Ltd in asset management, Newedge in brokerage and CLSA Asia Pacific Markets in securities management. The year 2010 saw changes to this organisation with CAAM Hong Kong Ltd becoming Amundi Hong Kong Ltd and exiting from Crédit Agricole CIB (the new name of Calyon). In the following years, CLSA and Newedge Group were both sold.

Nowadays, the Group is present in Hong Kong through Crédit Agricole CIB for investment and corporate banking, Amundi in asset management and a CA Indosuez (Switzerland) SA branch office handling private banking.