Managing your assets: life insurance

Life insurance policies allow you to save in order to protect your loved ones on your death, and much more besides: they also allow you to grow your savings over the long term, finance major life events and plan for your retirement by building up an additional source of income.

Let’s take a look at France’s preferred investment solution.

How a life insurance policy works

The main types of policy

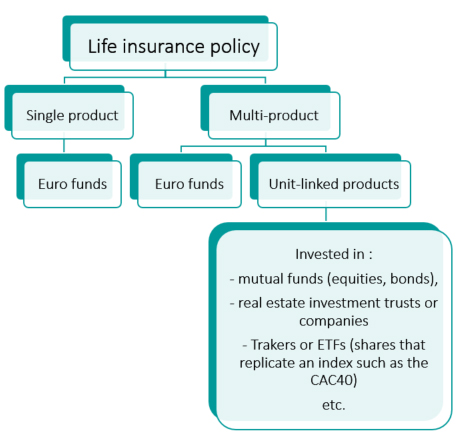

There are two main types of life insurance policy: single product policies (in euros) and multi-product policies.

As the name implies, a single product policy invests in one type of vehicle known as a euro fund.

A multi-product policy includes a euro fund investment and unit-linked investments, which may invest in different types of assets (equities, bonds, etc.), different geographical regions (France, Europe, United States, etc.), and different themes (diversified, real estate, socially responsible investments, etc.). The returns on unit-linked investments vary in line with fluctuations in the financial markets. They can potentially provide higher returns than euro funds but they also have a higher risk of capital loss.

It is important to think carefully about how you want to balance risk and return.

Saving in your life insurance policy

When you take out a life insurance policy, you may be advised to make an initial payment to “set the start date”. What does this mean? It means purchasing a life insurance policy with the minimum initial investment (€30 is enough for some policies). This sets the start date for your policy, which will determine when you will be eligible for the special tax treatment available for life insurance policies. (See the section on taxation below.)

You can make one-time and/or regular payments into your policy. Regular payments can be made monthly, quarterly, or yearly. You can stop making regular payments at any time and resume them when you wish.

Reallocation

You can adjust the allocation of your investments with a “reallocation”. For example, you may decide to invest most of your savings in a unit-linked product at the start of the contract, then gradually reduce your risk exposure by reallocating your savings to euro funds.

Management

If you decide to invest in one or more unit-linked products (equities, bonds, etc.), you can choose between different ways of managing your savings.

You can manage your savings yourself, by setting the amount to be invested in euro funds and unit-linked products, choosing the assets in which you invest (equities, bonds, real estate, etc.) and reallocating your savings whenever you choose. This is the self-managed investment solution.

If you are not an investment expert, you can choose to delegate the management of your policy to a financial market specialist under an allocation mandate. The specialist will make the necessary adjustments to your portfolio on your behalf, based on your risk profile.

Or you can be guided in your decisions by a professional, while remaining free to choose whether to follow his or her recommendations: this is the investment advisory solution.

Withdraw your money whenever you choose

Availability of your savings

Contrary to popular belief, you can withdraw your savings at any time. You can make partial withdrawals (also known as redemptions) whenever you choose.

You may be liable for tax on interest and income, depending on how long you have held your policy.

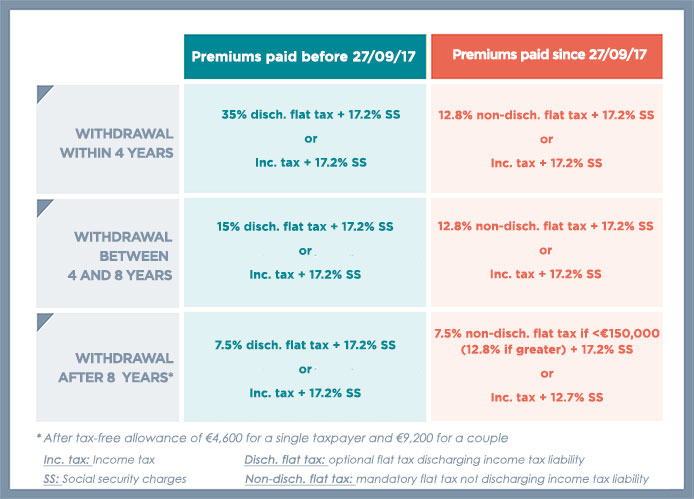

=> See the table below on Taxation on withdrawal

Taxation on withdrawal

The following table shows the tax treatment of income when you withdraw your savings.

Important points:

- Only interest and income are taxed;

- When your policy is eight years old, you benefit from an annual tax-free allowance of €4,600 in interest and income for a single taxpayer or €9,200 for a married couple or civil union partners who are taxed jointly.

Example :you are married and withdraw some of your savings from your life insurance policy, which is more than eight years old. If the amount of your interest and income is below €9,200, you will not be liable for income tax. This allowance is available each year, meaning that you can make a second withdrawal the following year and benefit from the €9,200 tax-free allowance again.

However, social security contributions are still payable.

There are exemptions from income tax on interest and income: if you are dismissed from your job, obliged to take early retirement or if your non-salaried employment is terminated. These exemptions apply to the policyholder and his/her spouse. In these cases, interest is not liable for income tax.

An exemption from social security contributions also applies (as well as the income tax exemption) in case of category 2 or 3 disability.

Did you know?

If you took out a life insurance policy before 1983, it is automatically exempt from income tax.

Specific tax rules on your death

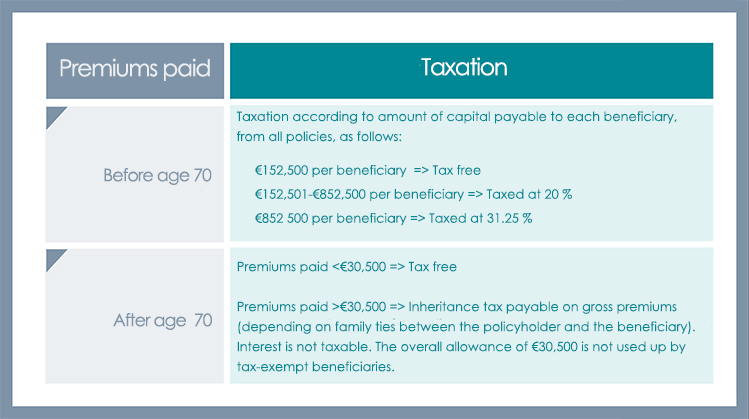

When you take out a life insurance policy, you must name the beneficiary or beneficiaries in case of your death.

Your savings will be transferred to the named beneficiary or beneficiaries outside your estate, irrespective of the legal order of inheritance (unless the premiums were clearly disproportionate). You can therefore pass on your money to whomever you choose, free of inheritance tax (for premiums paid before your 70th birthday and interest on premiums paid thereafter).

If no beneficiary is named, the life insurance policy will be included in the estate assets and inheritance tax will be payable. See the table below.

Taxation on the policyholder’s death - for all policies opened after 13 October 1998

(tax rules in force as of 01/01/2020)

The amounts passed on are tax-free if the named beneficiary is the policyholder’s spouse or civil union partner or, in some cases, his/her brothers and sisters. (TEPA law on Labour, Employment and Purchasing Power).

Reminder of benefits

Life insurance offers many advantages, as seen above:

- A wide range of investments: money markets, equities, bonds, etc.

- Tax benefits linked to the age of your policy;

- You can withdraw your savings at any time;

- Tax benefits on death.