Crédit Agricole 140 years of history : 1930s - Helping farmers through the crisis

The 1929 crisis that began in the United States reached France in the following years.

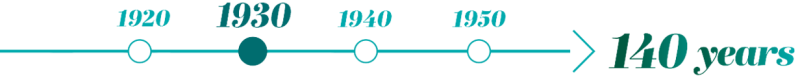

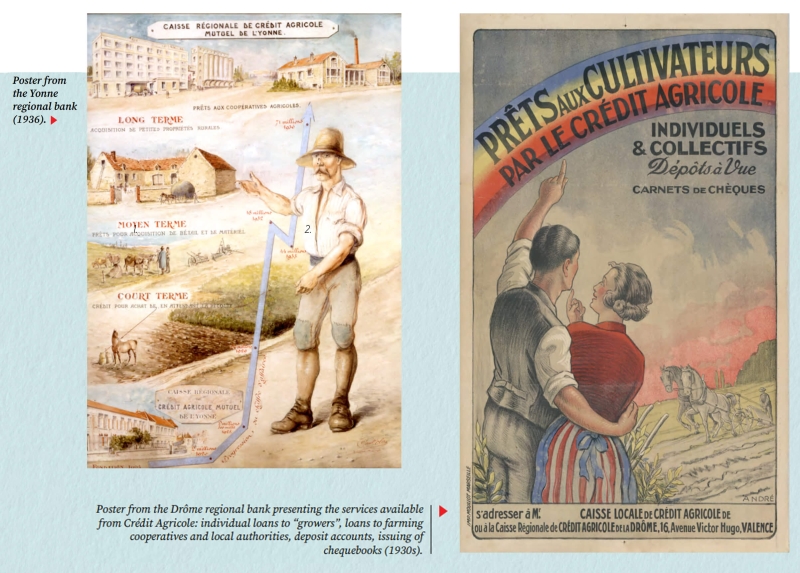

The farming sector was not spared. Prices of agricultural products plummeted, and some farmers were unable to repay their loans. Crédit Agricole decided to spread out repayments to avoid the bankruptcy of its borrowers. It also had to pay attention to its own financial situation and, to cope with future crises, in 1935 it set up a joint deposit guarantee fund for the regional banks, aimed at ensuring greater stability and financial solidarity for the institution. At the same time, the government decided to tackle the problem of cereal overproduction by establishing the National Interprofessional Cereal Office (ONIC) in 1936.

This new establishment organised the storage of cereals to support and regulate the market: sales cooperatives purchased seeds at the prices and on the terms set by the ONIC to store them and stagger their sale. Crédit Agricole was at the heart of this system, as the financial flows passed through its banks. This organisation had a direct impact on farmers’ daily lives: payments were increasingly made by cheque. Crédit Agricole therefore improved the provision of banking services to rural households.

In the same Series

-

Crédit Agricole 140 years of history: 2025 until todayCrédit Agricole is now an original model of universal retail banking.

Crédit Agricole 140 years of history: 2025 until todayCrédit Agricole is now an original model of universal retail banking. -

Crédit Agricole 140 years of history: 2010s - The expression of our “Raison d’être”At the beginning of this decade, Crédit Agricole: included 39 regional banks, fully-fledged banks and the majority shareholders of the central institution Crédit Agricole S.A.; was active in all banking businesses; provided services to all types of customers, from individuals to corporates and institutional investors, from the most vulnerable to the wealthiest; included a second retail banking network, LCL; was present throughout France and on all continents.

Crédit Agricole 140 years of history: 2010s - The expression of our “Raison d’être”At the beginning of this decade, Crédit Agricole: included 39 regional banks, fully-fledged banks and the majority shareholders of the central institution Crédit Agricole S.A.; was active in all banking businesses; provided services to all types of customers, from individuals to corporates and institutional investors, from the most vulnerable to the wealthiest; included a second retail banking network, LCL; was present throughout France and on all continents. -

Crédit Agricole 140 years of history: 2000s - A new dimensionIn 2001, the regional banks, the majority shareholders of Caisse Nationale de Crédit Agricole, decided to open up its capital to the public.

Crédit Agricole 140 years of history: 2000s - A new dimensionIn 2001, the regional banks, the majority shareholders of Caisse Nationale de Crédit Agricole, decided to open up its capital to the public. -

Crédit Agricole 140 years of history: 1990s - A growing groupCrédit Agricole, no longer under government supervision, was now in control of its destiny. It completed its goal of becoming a universal bank with the ambition of being useful to all.

Crédit Agricole 140 years of history: 1990s - A growing groupCrédit Agricole, no longer under government supervision, was now in control of its destiny. It completed its goal of becoming a universal bank with the ambition of being useful to all. -

Crédit Agricole 140 years of history: 1980s - The beginnings of universal bankingIn the early 1980s, Crédit Agricole operated throughout France, including in the largest urban areas. It also began to develop its international network with a growing number of new locations (Frankfurt, Milan, Cairo, Singapore, etc.).

Crédit Agricole 140 years of history: 1980s - The beginnings of universal bankingIn the early 1980s, Crédit Agricole operated throughout France, including in the largest urban areas. It also began to develop its international network with a growing number of new locations (Frankfurt, Milan, Cairo, Singapore, etc.). -

Crédit Agricole 140 years of history: 1970s - From rural to internationalFrom 1971, Crédit Agricole’s geographical scope gradually expanded.

Crédit Agricole 140 years of history: 1970s - From rural to internationalFrom 1971, Crédit Agricole’s geographical scope gradually expanded. -

Crédit Agricole 140 years of history: 1960s - A decade of renewalSince 1897, Crédit Agricole received advances from the government each year, which it had to repay.

Crédit Agricole 140 years of history: 1960s - A decade of renewalSince 1897, Crédit Agricole received advances from the government each year, which it had to repay. -

Crédit Agricole 140 years of history: 1950s - Expansion of the networkIn the early 1950s, Crédit Agricole developed savings inflows to boost financing for French farmers.

Crédit Agricole 140 years of history: 1950s - Expansion of the networkIn the early 1950s, Crédit Agricole developed savings inflows to boost financing for French farmers. -

Crédit Agricole 140 years of history: 1940s - War and reconstructionThe Second World War disrupted the organisation of Crédit Agricole.

Crédit Agricole 140 years of history: 1940s - War and reconstructionThe Second World War disrupted the organisation of Crédit Agricole. -

Crédit Agricole 140 years of history : 1920s - Electricity and housingThe birth of the Caisse Nationale de Crédit Agricole

Crédit Agricole 140 years of history : 1920s - Electricity and housingThe birth of the Caisse Nationale de Crédit Agricole -

Crédit Agricole 140 years of history : 1910s - Serving the entire countryAt this time, two important measures strengthened Crédit Agricole’s action in its fight against rural depopulation.

Crédit Agricole 140 years of history : 1910s - Serving the entire countryAt this time, two important measures strengthened Crédit Agricole’s action in its fight against rural depopulation. -

Crédit Agricole 140 years of history : 1900s - First extension of the scope of actionThe first decade of the 20th century saw Crédit Agricole establish a lasting presence in the regions.

Crédit Agricole 140 years of history : 1900s - First extension of the scope of actionThe first decade of the 20th century saw Crédit Agricole establish a lasting presence in the regions. -

Crédit Agricole 140 years of history : 1890s - A bottom-up organisationCreation of the local banks

Crédit Agricole 140 years of history : 1890s - A bottom-up organisationCreation of the local banks -

Crédit Agricole 140 years of history : 1880s - Creation in the JuraOur story begins in 1885 in Salins-les-Bains in the Jura.

Crédit Agricole 140 years of history : 1880s - Creation in the JuraOur story begins in 1885 in Salins-les-Bains in the Jura.