-

View article

#Financial publications

#Financial publicationsInterview with Clotilde L’Angevin - Significant full-year earnings and a transitional fourth quarter marked by the launch of the new MTP

2026/02/04 -

View article

#Financial publications

#Financial publicationsInterview with Olivier Gavalda - Results that reflect teams’ commitment to serving our customers and society

2026/02/04 -

View article

#Economy

#EconomySouth Korea: a year after the political crisis, markets are buying the promise of stability

2025/12/17

Performance and compensation

Annual performance review

The development of Crédit Agricole S.A. employees’ skills is inherent to the company’s Human-centric Project. To adapt to changing business roles, various mechanisms are in place within the Group.

Thus, annual discussions between employees and their manager aim to establish a progress feedback loop to foster professional development.

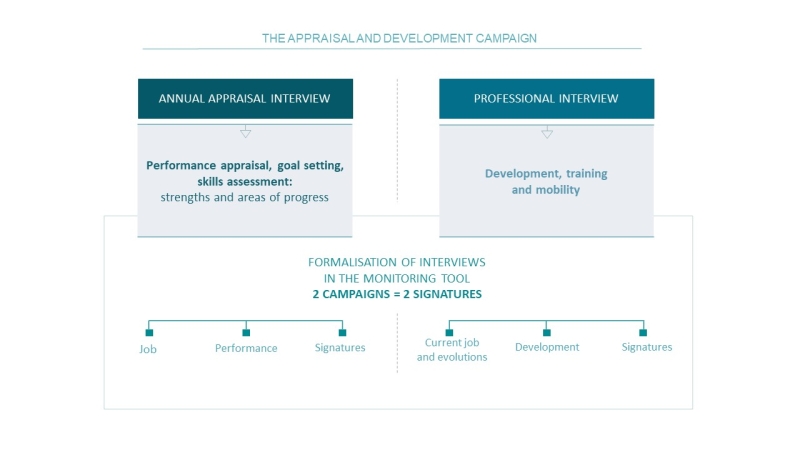

To this end, the Group’s appraisal and development campaign is structured around two annual interviews: the appraisal and the professional interview. Both interviews are formalised in a career monitoring and management tool.

Annual appraisal

Each employee in permanent employment has an annual appraisal interview to review the year in question.

Employees are asked to conduct a self-assessment and suggest objectives for the upcoming year.

After discussions, the manager finalises the appraisal and approves the objectives for the upcoming year. Managers also save in the career management tool any strengths and areas for improvement, following an assessment of professional skills.

The latter cover in particular:

- Hard skills: general, technical or specific knowledge necessary to carry out the employee’s function.

- Soft skills: attitudes and behaviours that are applicable to all functions

- Managerial skills: specific skillset expected from employees in managerial positions.

Additionally, since 2022 the Group has been rolling out a new 360° feedback system that encourages discussion and the ongoing development of employees throughout the year. Requests for such feedback are made by employees directly, and can also be requested from other work colleagues, including project managers, peers, team members etc.

Annual professional interview

This interview is an opportunity for employees to develop a professional career plan that is consistent with their career path, skills and prospects, and relevant to the Group's needs.

The professional interview is a legal obligation for French companies, to be carried out every two years.

Within Crédit Agricole S.A. in France, a professional interview is planned every year, and a summary interview that reviews the career to-date of the employee takes place every six years.

Overall compensation policy

As a leading player in the banking market, both nationally and internationally, Crédit Agricole S.A. applies a compensation policy that aims to align the interests of Clients, Shareholders and Employees in an increasingly competitive and regulated market.

This compensation policy contributes to conveying the values of fairness, transparency and usefulness, which are key to the Group. It contributes to the implementation of the three founding principles of the Human-centric project, drivers of the Group’s Raison d'Être: accountability of employees, boosting customer proximity and developing a framework of trust.

The compensation of employees and senior managers is determined on the basis of precise and clear criteria that reflect the skills used and the seniority, individual and collective performance delivered within the context of the organisation's sustainable responsibility.

Fixed elements, social benefits and peripheral elements together constitute the Group’s compensation policy. Each of these elements meets different objectives in terms of remuneration of performance in the short and long term, consistent with the 2022-2025 MTP.

Employees may benefit from all or part of these components, depending on their level of responsibility, skills and performance:

- Fixed remuneration,

- Annual variable remuneration, linked with reaching individual and/or collective objectives consistent with the 2022-2025 Medium-Term Plan,

- Collective variable remuneration, according to the entity’s annual performance,

- Long-term variable remuneration, for executive managers, according to the Group’s economic, stock market and societal performance,

- Peripheral benefits add to direct remuneration, and includes retirement, healthcare and pension schemes.

Since 2020, 14 million euros have been dedicated by Crédit Agricole S.A. specifically to ensure equal wages between men and women.

Collective variable remuneration and peripheral compensation

- Company Savings Plan (PEE): 100% of employees in France have access to a company savings plan with matching contributions from Crédit Agricole S.A. entities.

- Group Retirement Savings Plan (PERCOL): 100% of employees in France have a PERCOL, which is also funded by Crédit Agricole S.A. entities.

- Profit-sharing and incentive plans: 100% of employees in France benefit from profit-sharing agreements and incentive plans specific to each entity.

- Life insurance: 100% of employees in France are covered by providence schemes with partial or total coverage of contributions (death, disability, temporary incapacity to work) depending on the entity of belonging.

- Health insurance: 100% of employees in France are covered by a health insurance policy. Depending on the entity, the basic plan is mandatory or optional for spouses and children. Some entities have also taken out supplementary hospitalisation and specialist insurance policies.

In 2024:

6.54%

of the Group’s share capitalis held by the Group’s employees and former employees

Additional benefits

Throughout their careers, employees have access to a number of benefits offered by the Group, Crédit Agricole S.A. and the works council (Comité Social et Economique, or CSE) of each entity. These benefits aim to improve employees’ work-life balance.

The Individual Social Report given to each employee every year provides an overview of the benefits received during the year: components of compensation and, in particular, the company's participation to supplementary health insurance, retirement and life insurance schemes, and the social and cultural activities handled and suggested by the works council.

Other benefits include the partial refund of public or active transport costs, subsidies to the various staff canteens, monetisation of leave credits, and long-term service awards.

Paying a fair, living wage

In 2022, the Group Human Resources Department established a workgroup to launch a living wage initiative within Crédit Agricole S.A. and all its subsidiaries worldwide.

To this end, the Group has adopted the Fair Wage Network’s definition of a living wage, i.e. A wage that ensures minimum acceptable living standards. It enables workers and their families, depending on their geographical location, to have an acceptable standard of living while participating in social and cultural life. It aims to cover the basic needs of a family (two working adults, and a number of children corresponding to the country’s fertility rate) comprising all necessary areas of expenditure, and in particular housing, food, child care, education, health care, transport and communication, and enough remaining for leisure and/or precautionary savings in order to cope with potential unforeseen expenditure.

The review of payroll data as at end 2024 used the methodology and database of Fair Wage Network, and showed that 100% of employees1 within Crédit Agricole S.A. receive a living wage.

Executive compensation

Compensation awarded for 2024

The Chairman of the Board of Directors only receives fixed compensation.

The annual variable compensation of corporate officers is partly paid immediately and partly deferred.

Click here to find out more about executive compensation (URD 2024).

|

2025 compensation policy

The main purpose of the Executive Corporate Officers’ compensation policy is the recognition of performance over the long term and the smooth implementation of the Group’s strategic plan.

The policy is aligned with the social interests of the company, as it takes into account aspects of sustainable performance as well as short-term financial results.

Performance assessment for 2025

Annual variable compensation

To ensure complete independence in the performance of his duties, the Chairman of the Board of Directors does not receive any variable compensation.

The Chief Executive Officer and Deputy Chief Executive Officers are eligible for individual variable compensation, the amount of which for a given financial year is contingent on performance. Up until the General Meeting of 14 May 2025, the target is set respectively at 100% and 80% of their fixed compensation, capped at 120% if the target is exceeded.

As from the General Meeting of 14 May 2025, the new target for the Deputy Chief Executive Officer is increased from 80 to 100%, to take into account the increased responsibilities of the Deputy Chief Executive Officer in light of the tighter executive governance structure, with a maximum level remaining unchanged at 120%.

Performance assessment is based on criteria defined by the Board of Directors, as described in the Universal Registration Document here.

Long-term incentive plan

Executive corporate officers whose term of office at Crédit Agricole S.A. will expire at the end of the General Meeting of 14 May 2025 are no longer eligible for long-term variable compensation in the form of free performance shares awarded by the Board in 2025.

Executive corporate officers remaining in office at Crédit Agricole S.A. at the end of the General Meeting of 14 May 2025 qualify for long-term variable compensation in the form of free performance shares awarded by the Board in 2025, within the framework of a budget strictly limited to 0.1% of the share capital, in order to strengthen their contribution to the creation of long-term value of Crédit Agricole S.A.

The number of shares allocated each year by the Board of Directors, whose acquisition contingent on the achievement of a target performance, is capped at a value of 20% of the annual fixed compensation. Overperformance may lead to the the delivery of the maximum number of shares, i.e. 120% of this target allocation.

The acquisition of these shares is determined, in particular, by the fulfilment of three demanding conditions regarding economic, stock market, environmental and societal performance assessed over a period of five years.

The acquisition of the shares is followed by a retention period of one year.

In addition, the senior executives are required to hold, until they leave office, 30% of the shares acquired each year.

1 Active employees