European Union : after oil, gas ? How best to respond ?

The European Council recently imposed an official embargo on Russian oil.

The intention is to further dissuade importing companies, shipping lines, insurers and financiers from any involvement in buying Russian oil. In theory, these incentives should result in a steeper discount on the price of Russian oil. The extent of the discount and the impact on Russian production will depend on Russia’s ability to divert its output to Asia. For the time being, the shift in European demand to other suppliers is straining the global market and pushing up prices, with the expected increase in production announced by OPEC deemed insufficient by markets.

What about capping energy prices? The debate moves forward

There are no plans for an embargo on Russian gas: with alternative sources hard to find, slowly reducing reliance on Russian imports is seen as being the only real way forward. There is, however, scope for action on prices. A number of countries, including Italy, Spain, Belgium, Portugal and Greece, have put forward proposals either to cap the price of gas (through a cap or fluctuation bands on prices traded on the virtual market in the Netherlands and a cap on liquefied natural gas shipping costs) or to decouple gas and electricity prices. However, their proposals have thus far met with scepticism from the Netherlands and Germany.

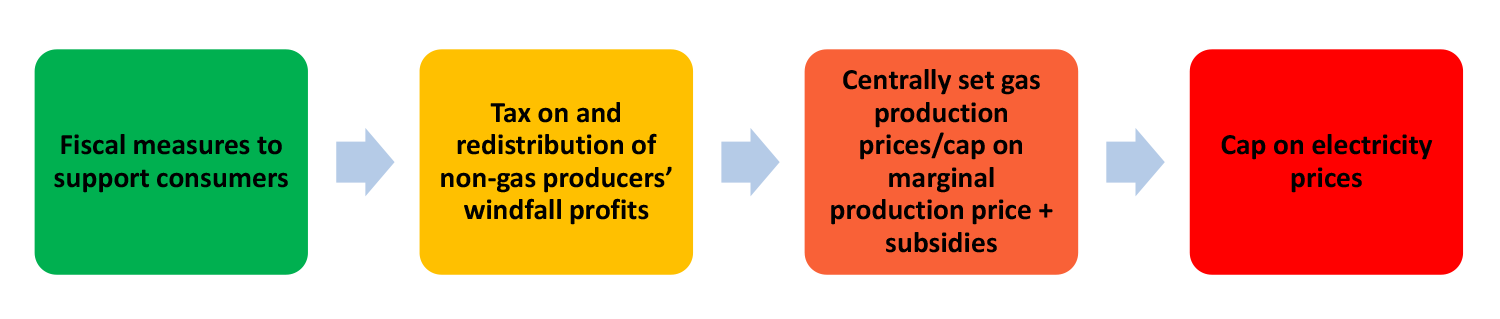

The Commission has hitherto tended to welcome this type of solution. It has already analysed the various options: financial compensation for fossil energy producers as the counterpart for lower prices, a direct cap on wholesale electricity prices or regulatory intervention to limit the amount of profit made by certain market participants. The Commission has already described the pros and cons of such mechanisms: they hinder competition, dissuade investment, notably in alternative energy, and disincentivise supply more generally. The ACER (Agency for the Cooperation of Energy Regulators) report, requested by the Commission and made public in May, did not come up with any solutions other than those already explored by the Commission. While conceding that the European electricity market was not designed to cope with emergencies like the one Europe currently faces, it set out the same options and highlighted the risks associated with ill-conceived emergency measures. However, ACER does classify these measures according to how “dangerous” they are – a classification from which the Commission could take inspiration. But the report has been judged fundamentally disappointing, with the Commission’s president describing it as a “very small step”.

A consensus seems to have been reached on the need for urgent action and the European Council has asked the Commission to quickly take forward work on optimising the operation of the European electricity market, including the impact of gas prices on that market. Tying renewable energy prices to the price of gas might perhaps have been warranted when gas was the predominant form of energy used to produce electricity. Today, though, with renewable energy accounting for a growing share of the energy mix, there appears to be no further justification for linking renewable energy to gas prices. There is even less justification at a time when gas prices are highly volatile, and when this link is resulting in extraordinary profits for renewable energy producers.

Any solution enabling the market to withstand excessive present and future price volatility so as to be able to supply affordable electricity will need to be assessed in light of certain constraints: the need for a market suited to a carbon-free energy system, the maintenance of incentives in support of ecological transition, the safeguarding of supply security, preservation of the single market and, lastly, the need to limit fiscal costs.

Ranking of options for counteracting rising energy prices: from most to least desirable (ACER report)

Pending a joint decision on gas, individual countries are each making their own way, trying to limit the fiscal impact of the measures they adopt.

The first best choice

From a macroeconomic perspective, the current situation calls for the debate over the right policy mix (fiscal vs. monetary) to shift to the field of regulatory policy. Given that what we have is a typical supply shock triggered by a market failure (due to the power of a monopolistic supplier), state intervention in prices is justified and looks to be better than any other solution.

Intervention to temporarily decouple electricity and gas prices is the only kind that could stamp out inflation. Neither fiscal policy in support of purchasing power nor action by the central bank would succeed.

The only way fiscal policy could translate into lower inflation would be by acting on tax rates on energy, but this would come at a high fiscal cost. Monetary policy cannot slow commodity-linked inflation by hiking interest rates; all it can do is interrupt the link between inflation and rising wages by causing economic activity and demand for labour to slow. This link is not yet visible in the eurozone. The central bank can, however, work to prevent economic agents anchoring their expectations on higher inflation by showing its determination to combat the latter. But the cost in terms of lost activity could prove high if the result were uncontrolled imported inflation, which would undermine its credibility. Lastly, the idea of using trade policy to impose import tariffs on imports of Russian gas has also been explored. The rationale for such an approach would be twofold: on the one hand, it would raise prices for consumers and thus limit demand; and on the other, it would lower pre-tariff prices and distribute the tariff income to consumers. But these twin benefits are wholly reliant on the assumption that Russia would lower its prices, which is by no means a foregone conclusion.

The next European Council meeting at the end of June could yield a decision on capping energy prices; however, the risk of Russia hitting back by withholding gas supplies will have increased in the meantime. The real challenge for the European Union will be to maintain a united front, take coordinated action and pursue solidarity policies – the foundations of a future single market for energy.